How to calculate GST on freight in Sales?

Calculating the GST for freight Transaction

According to the GST norms, tax is levied on the freight charges collected in the bill.

1. In Sales

When freight charge is included, according to the GST regime the highest tax in the bill is applied upon the delivery charge that has been charged. Let us see how to configure it (Followed by a quick product tour on how to enable it).

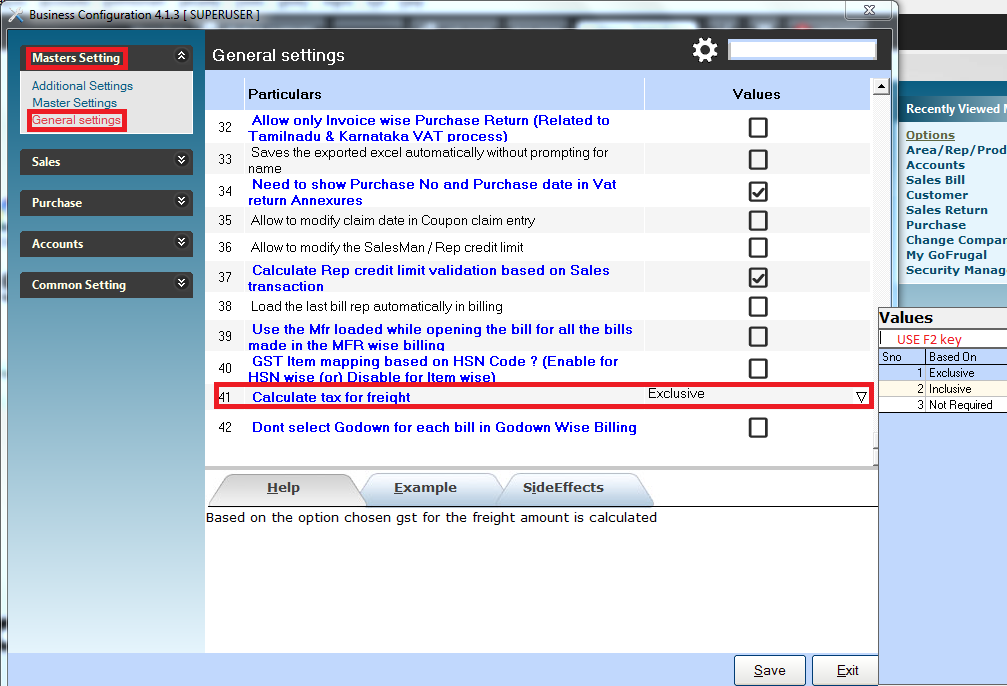

i) Go to tools->options->options.under master settings click on general settings,choose the calculate tax for freight option.

ii) Use function key F2 to select the option depending upon your business needs to make it either inclusive or exclusive of charges.

iii)Now go to the sales bill and when you press f2 to save the bill you can enter the freight charges and when you press Enter stroke you can enter corresponding freight tax. the highest tax in the bill gets pointed by default you can also select the required tax.

iv)We have also provided the corresponding fields in print namely.

According to the GST norms, tax is levied on the freight charges collected in the bill.

1. In Sales

When freight charge is included, according to the GST regime the highest tax in the bill is applied upon the delivery charge that has been charged. Let us see how to configure it (Followed by a quick product tour on how to enable it).

i) Go to tools->options->options.under master settings click on general settings,choose the calculate tax for freight option.

ii) Use function key F2 to select the option depending upon your business needs to make it either inclusive or exclusive of charges.

iii)Now go to the sales bill and when you press f2 to save the bill you can enter the freight charges and when you press Enter stroke you can enter corresponding freight tax. the highest tax in the bill gets pointed by default you can also select the required tax.

iv)We have also provided the corresponding fields in print namely.

Related Articles

Migrating to Next-Gen GST (GST 2.0) in Gofrugal ManageEasy

Gofrugal ManageEasy now supports Next-Gen GST (GST 2.0) to help your business stay compliant with the latest tax regulations. To migrate, update your application to the latest version (6.5.0.6) and follow the steps below along with the help videos: ...Currency Master and Export Sales bill

How to create new currency and make export sales bill in ManageEasy Purpose: Creating a new currency in Gofrugal ManageEasy allows businesses to handle international transactions in the customer's preferred currency. Export sales bills can then be ...Manage separate ledger posting for Sales and Purchase freight amount

To have a Separate ledger posting for Sales and Purchase Freight amount, please find the below steps. Click on Tools-->Options-->Options Search for the configuration "Separate ledger posting for Sales and Purchase Freight amount" and enable it. Make ...Customer Category Wise sales bill

The customer category-wise sales bill is to categorize sales bills by customer type in Gofrugal ManageEasy for better tracking and analysis of buying patterns. It helps you optimize inventory, plan better promotions, and improve customer service. To ...TCS in ManageEasy - Sales invoice

What is TCS(Tax collected at source)? Click the link to know about the TCS concept. Below are the steps to easily make a TCS entry for a sales entry Required software version - GOFRUGAL ManageEasy 6.3.6.4 #Enabling the configuration (When a business ...