How does a Purchase formula work?

Default Purchase formula:

The basic formula is Invoice Amount = A+B+C

A = Gross Amount(+)

B = Cash discount(-)

C = Tax(+)

How does Default Formula work?

Let us see how the default formula works with a simple example.

In the above example, for a cash discount of 10% and tax 5%, the default purchase formula works as follows.

Tax calculation based on Basic amount and Cash discount - [Default Formula]

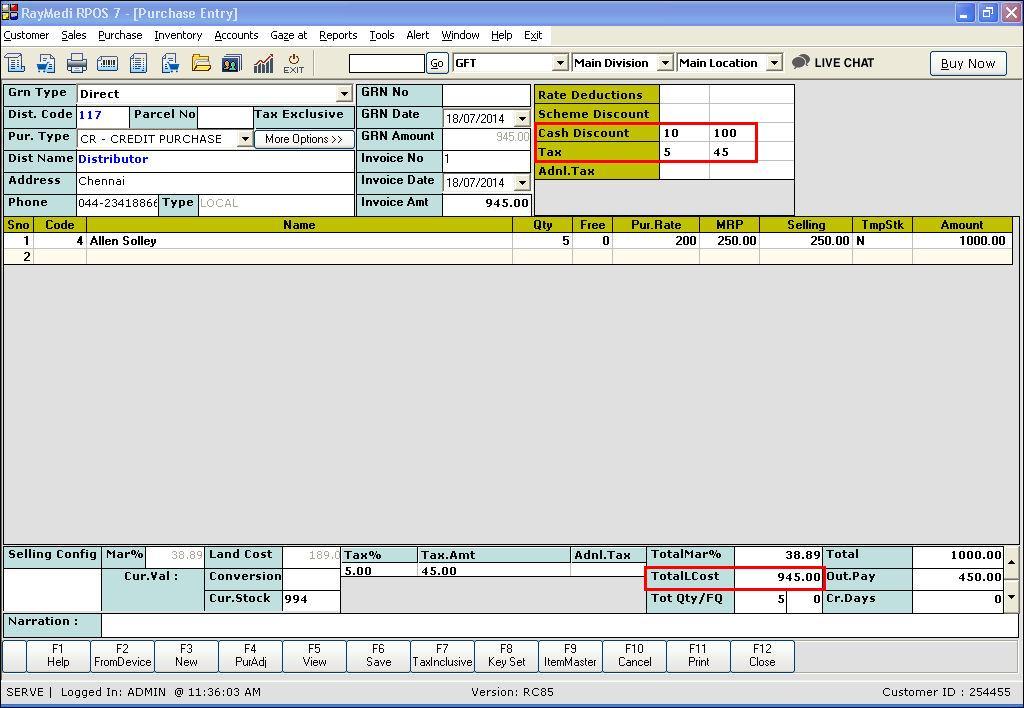

A sample purchase with the Default formula is shown in the below image.

Configuring a new Purchase formula

By default, the tax amount is calculated based on (basic amount + Cash discount). To apply the tax only for the Basic amount, you have to configure a new purchase formula.

Tax calculation based on Basic Amount only - [New Formula Configured]

This is how the new purchase formula works after configuration.

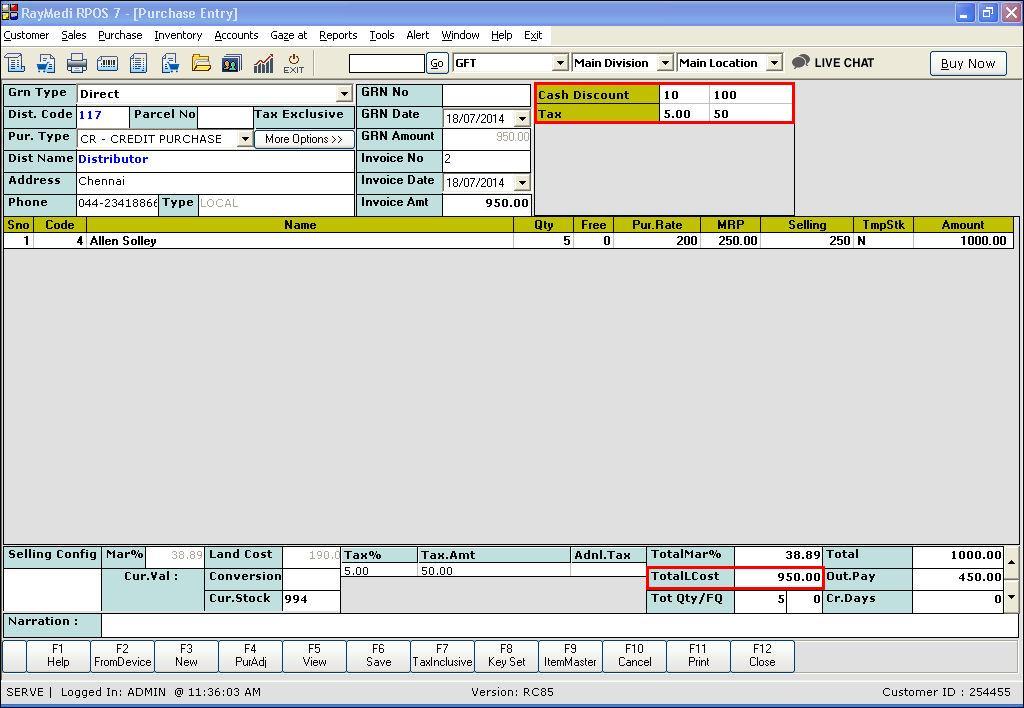

A sample purchase with the above formula is shown in the below image.

The basic formula is Invoice Amount = A+B+C

A = Gross Amount(+)

B = Cash discount(-)

C = Tax(+)

| Invoice amount= (Gross amount) + (-Cash discount) + (Tax) |

How does Default Formula work?

Let us see how the default formula works with a simple example.

| Item Name |

Qty |

Purchase Price |

Amount(Qty * purchase price) |

| X |

1 |

1000 |

1000 |

|

|

|

Gross Amount(Basic) |

1000 |

In the above example, for a cash discount of 10% and tax 5%, the default purchase formula works as follows.

Tax calculation based on Basic amount and Cash discount - [Default Formula]

| Caption |

Add/Sub |

Formula Calculation |

Result |

| Cash Discount |

- |

Basic Amount |

1000-100 = 900 |

| Tax |

+ |

Basic Amount + Cash Discount |

1000+(-100)= 900 Tax 5% =45 |

|

|

|

Invoice Amount |

945 |

A sample purchase with the Default formula is shown in the below image.

Configuring a new Purchase formula

By default, the tax amount is calculated based on (basic amount + Cash discount). To apply the tax only for the Basic amount, you have to configure a new purchase formula.

Tax calculation based on Basic Amount only - [New Formula Configured]

This is how the new purchase formula works after configuration.

| Caption |

Add/Sub |

Formula Calculation |

Result |

| Cash Discount |

- |

Basic Amount |

1000-100 = 900 |

| Tax |

+ |

Basic Amount |

Tax 5% of 1000 =50 |

|

|

|

Invoice Amount |

950 |

A sample purchase with the above formula is shown in the below image.

Related Articles

Purchase Formula with TCS

Purpose: Generally, The TCS amount would not be added in the invoice amount and the landing cost. But, If the TCS amount needs to be included in the invoice amount, it can be done with this feature " Purchase Formula with TCS" This feature is ...Overwrite tax-slab in Purchase/Receipt Note

Overwrite tax-slab in Purchase/Receipt Note Purpose: The purpose of the "overwrite tax-slab" option in a purchase/receipt note in a POS system is to allow the user to manually adjust the tax rate applied to a particular item or group of items. ...How to configure Price Level Vs Formula?

Price Level Formula To work with Price Level Formula, you must have created price levels in the Price level Master. The major advantage of using price level formula is that you can customize time period, that is you can set validity for the price ...Work Flow of Product Enquiry

Work Flow of Product Enquiry Purpose: The purpose of the product enquiry workflow in RetailEasy Electronics vertical POS is to allow customers to request information about products. This can be helpful for customers who are looking for specific ...TCS in Purchase Invoice

What is TCS? 'Tax collected at Source' is abbreviated as TCS. It was applicable for Sale of Goods for items like Tendu leaf, motor Vehicles, Scrap..etc. From 1st October 2020, TCS will be applicable on 'Sale of Goods' for all items. Both TDS & TCS ...