Manage separate ledger posting for Sales and Purchase freight amount

To have a Separate ledger posting for Sales and Purchase Freight amount, please find the below steps.

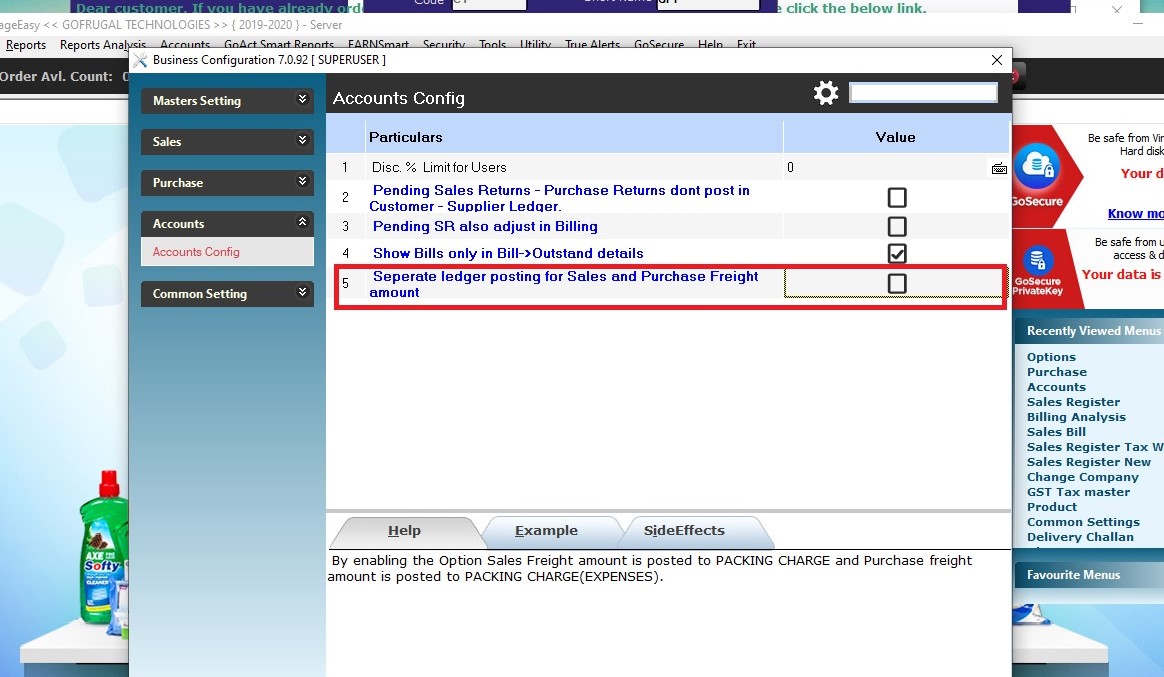

Click on Tools-->Options-->Options

Search for the configuration "Separate ledger posting for Sales and Purchase Freight amount" and enable it.

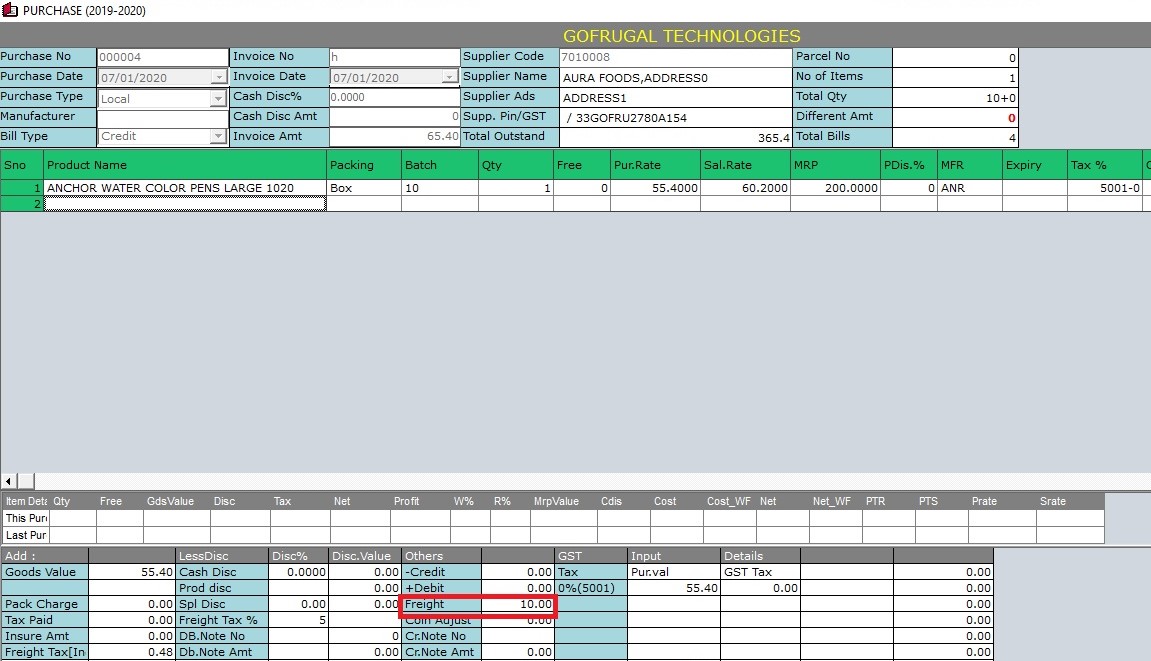

Purchase

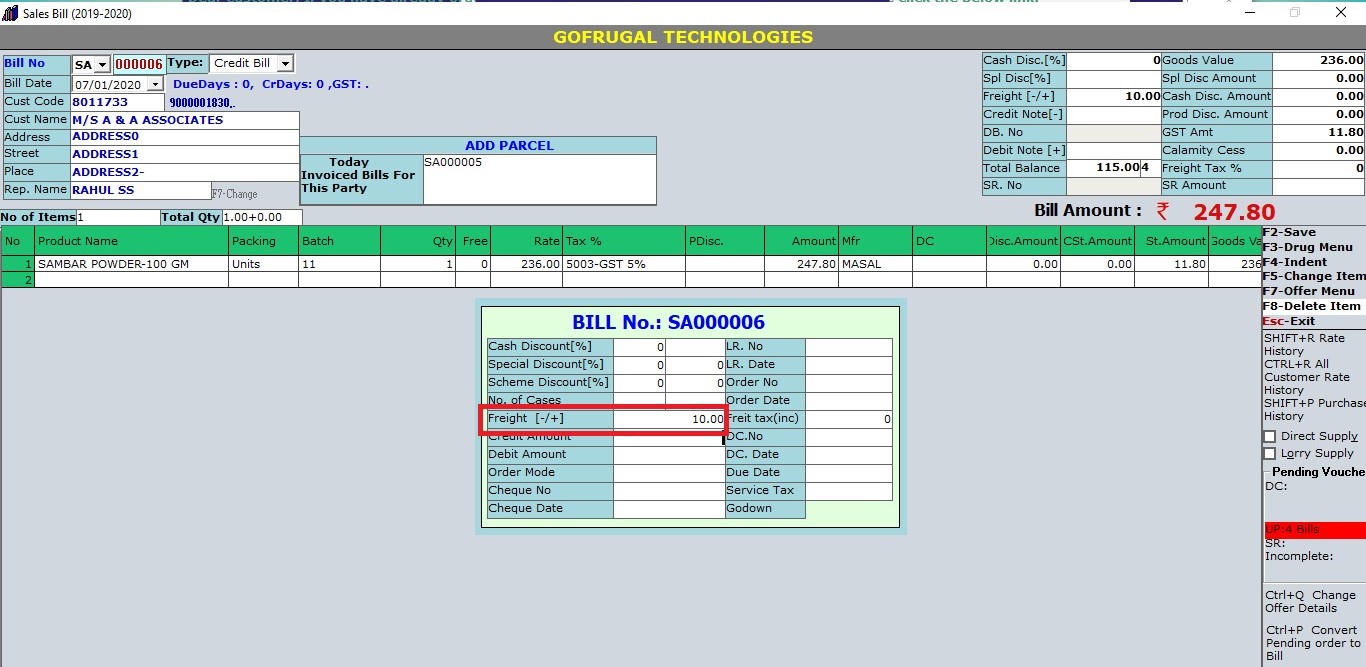

Sales

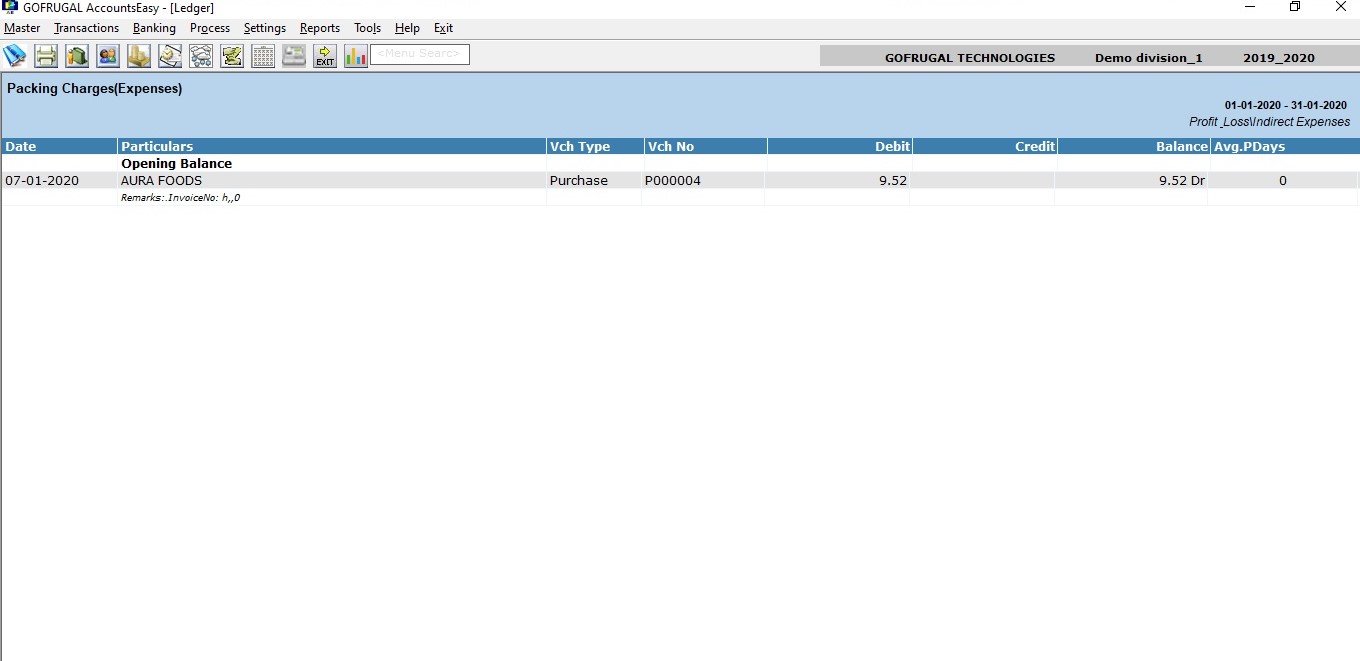

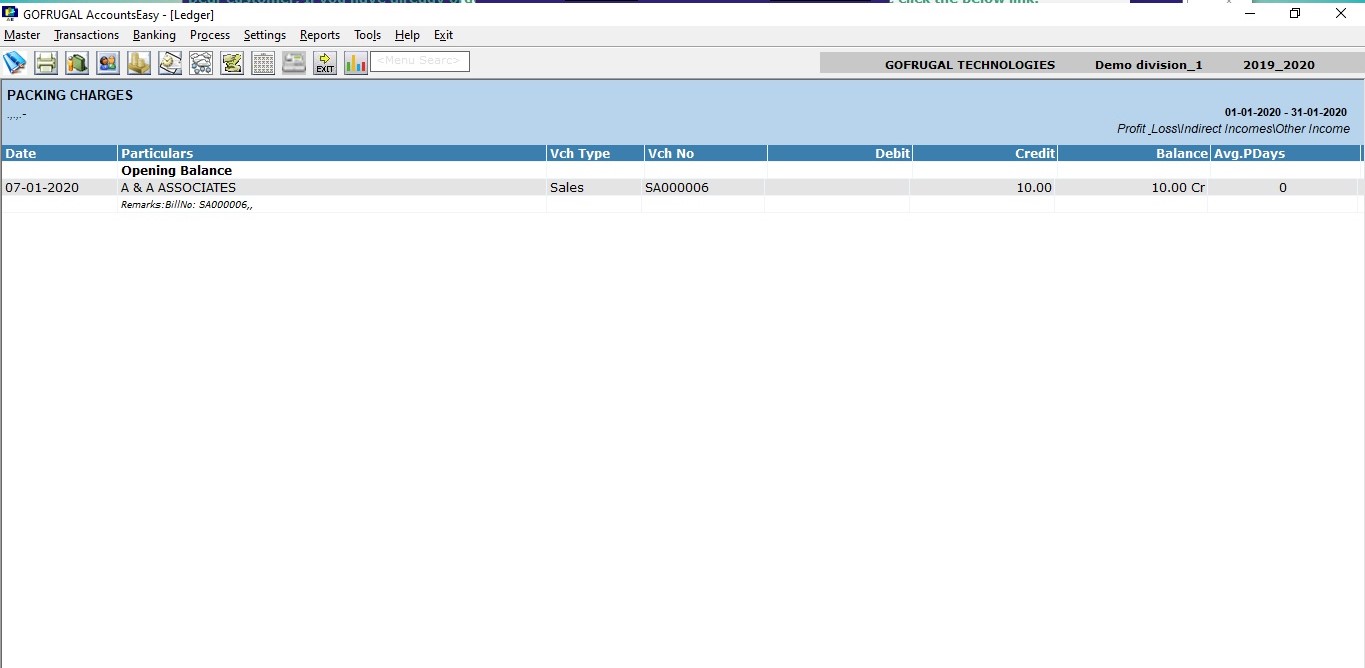

Now the freight amount given in purchase will be posted to ledger "PACKING CHARGES(EXPENSES)" and the ledger "PACKING CHARGES" for freight in sales.

To verify go to accounts and open Reports--Account Books>--Ledger reports, open the above-mentioned ledger after saving a purchase or sales with freight amount to check.

Related Articles

Customer Category Wise sales bill

The customer category-wise sales bill is to categorize sales bills by customer type in Gofrugal ManageEasy for better tracking and analysis of buying patterns. It helps you optimize inventory, plan better promotions, and improve customer service. To ...Currency Master and Export Sales bill

How to create new currency and make export sales bill in ManageEasy Purpose: Creating a new currency in Gofrugal ManageEasy allows businesses to handle international transactions in the customer's preferred currency. Export sales bills can then be ...TCS in ManageEasy - Sales invoice

What is TCS(Tax collected at source)? Click the link to know about the TCS concept. Below are the steps to easily make a TCS entry for a sales entry Required software version - GOFRUGAL ManageEasy 6.3.6.4 #Enabling the configuration (When a business ...TCS in ManageEasy - purchase invoice

What is TCS(Tax collected at source)? Click the link to know about the TCS concept. Required software version - GOFRUGAL ManageEasy 6.3.6.4 #TCS for a purchase invoice In the purchase entry screen, enter the invoice details and click Save [F2]. ...How to manage expiry in Gofrugal ManageEasy?

Expiry management facilitates consumer expiry returns and makes it simple for suppliers to receive them by automatically determining an expiration date based on the actual manufacture date. It will also help to manage the credit note, debit note, ...