What is Purchase Formula?

Introduction

Purchase formula is a formula used to calculate the invoice amount including the discounts and taxes of the purchase. The default Purchase formula is not always helpful to the users as the invoice amount calculation varies for different suppliers based on the type of origin of the arrived goods, tax and other charges levied over the purchased items. Hence, there is a need for users to configure their own purchase formula that is suitable for their needs. The Purchase formula feature in RPOS7 caters to such needs.

Before going in detail, learn the basics.

A. Gross amount (Basic Amount)

Gross amount is the basic amount. It is the amount which includes purely the purchase price of the items without including other amounts such as a discount, tax, freight charges etc.

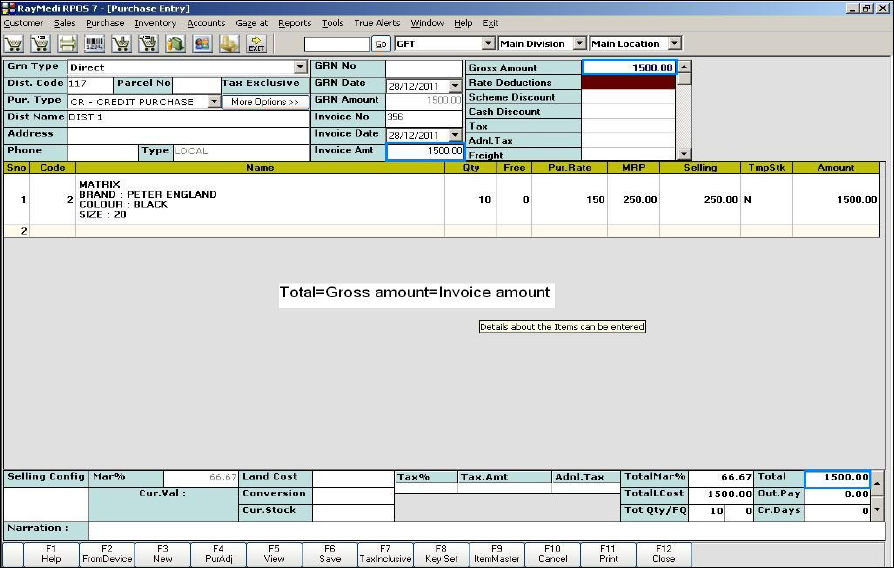

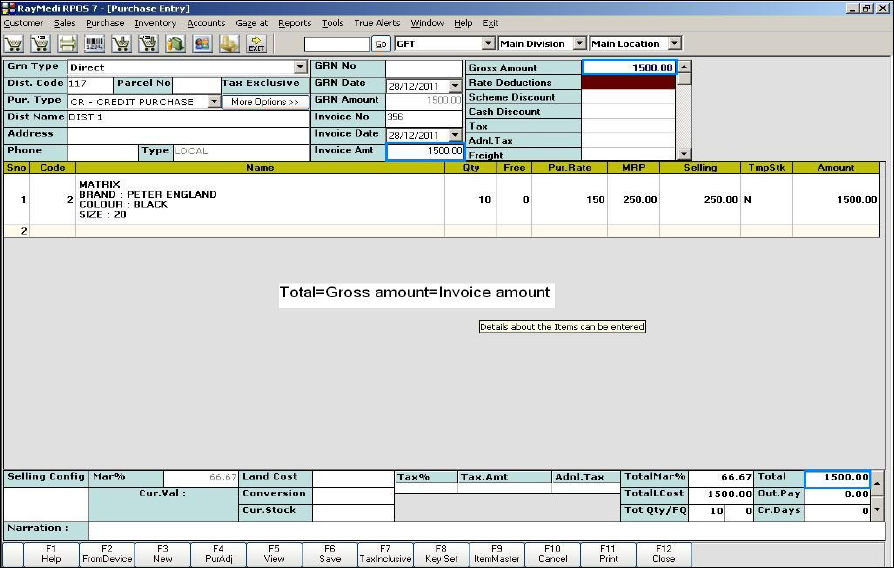

Please refer the below image.

In the above image, the Gross amount and Invoice amount are equal since the invoice does not include a discount, tax, or freight charges etc.

B. Cash Discount

Cash discount refers to a deduction from the original amount and is usually offered by the seller to the buyer. The Cash discount is also referred to as Sales discount by the seller and as Purchase discount by the buyer.

C. Tax

Tax refers to the additional charges levied on the items based on its origin i.e. from where the goods arrived. It is the amount that is paid to the supplier.

D. Landing Cost

Landing cost refers to the total cost of a landed shipment including Purchase price, freight charges, insurance and other costs incurred till the destination. In some instances, it may also include the customs duties and other taxes levied on the shipment.

Default Purchase formula:

The basic formula is Invoice Amount = A+B+C

A = Gross Amount(+)

B = Cash discount(-)

C = Tax(+)

For more details, click on the links below:

Purchase formula is a formula used to calculate the invoice amount including the discounts and taxes of the purchase. The default Purchase formula is not always helpful to the users as the invoice amount calculation varies for different suppliers based on the type of origin of the arrived goods, tax and other charges levied over the purchased items. Hence, there is a need for users to configure their own purchase formula that is suitable for their needs. The Purchase formula feature in RPOS7 caters to such needs.

Before going in detail, learn the basics.

A. Gross amount (Basic Amount)

Gross amount is the basic amount. It is the amount which includes purely the purchase price of the items without including other amounts such as a discount, tax, freight charges etc.

| Gross Amount = Quantity * Purchase Price |

Please refer the below image.

In the above image, the Gross amount and Invoice amount are equal since the invoice does not include a discount, tax, or freight charges etc.

B. Cash Discount

Cash discount refers to a deduction from the original amount and is usually offered by the seller to the buyer. The Cash discount is also referred to as Sales discount by the seller and as Purchase discount by the buyer.

C. Tax

Tax refers to the additional charges levied on the items based on its origin i.e. from where the goods arrived. It is the amount that is paid to the supplier.

D. Landing Cost

Landing cost refers to the total cost of a landed shipment including Purchase price, freight charges, insurance and other costs incurred till the destination. In some instances, it may also include the customs duties and other taxes levied on the shipment.

Default Purchase formula:

The basic formula is Invoice Amount = A+B+C

A = Gross Amount(+)

B = Cash discount(-)

C = Tax(+)

| Invoice amount= (Gross amount) + (-Cash discount) + (Tax) |

For more details, click on the links below:

- Purchase Formula Configuration

- Calculation Master

- Default Purchase Formula & new formula configuration

- Illustration with a sample copy

- Tax based on Item Master

Related Articles

Purchase Formula with TCS

Purpose: Generally, The TCS amount would not be added in the invoice amount and the landing cost. But, If the TCS amount needs to be included in the invoice amount, it can be done with this feature " Purchase Formula with TCS" This feature is ...How to use RetailEasy [RPOS7] Purchase Formula?

In Gofrugal RetailEasy (RPOS7), the Purchase Formula is one of the most important configurations, as it controls how your item’s purchase rate is calculated inside the software. This directly affects: Stock Value Profit Margin Selling Price decisions ...TCS in Purchase Invoice

What is TCS? 'Tax collected at Source' is abbreviated as TCS. It was applicable for Sale of Goods for items like Tendu leaf, motor Vehicles, Scrap..etc. From 1st October 2020, TCS will be applicable on 'Sale of Goods' for all items. Both TDS & TCS ...Purchase Return with Conversion Functionality

Purchase Return with Conversion Functionality: Purpose: The mentioned details highlight a new feature in the pharmacy retail outlet store POS system related to Purchase Return with Conversion functionality, specifically within the Pharmacy vertical. ...How to configure purchase formula using purchase formula screen?

Purchase Formula - MRC calculation Configuration Use the Purchase formula screen to configure the Purchase formula. 1. Click Purchase >> Purchase Formula. The MRC Calculation Configuration screen is displayed. 2. In the Formula name field, enter ...