Purchase Formula with TCS

Purpose:

Generally,

The TCS amount would not be added in the invoice amount and the

landing cost. But, If the TCS amount needs to be included in the

invoice amount, it can be done with this feature " Purchase Formula with

TCS" This feature is added along with an one time configuration. If

this configuration is enabled, a new calculation master will be enabled

and a default purchase formula with TCS will be created automatically.

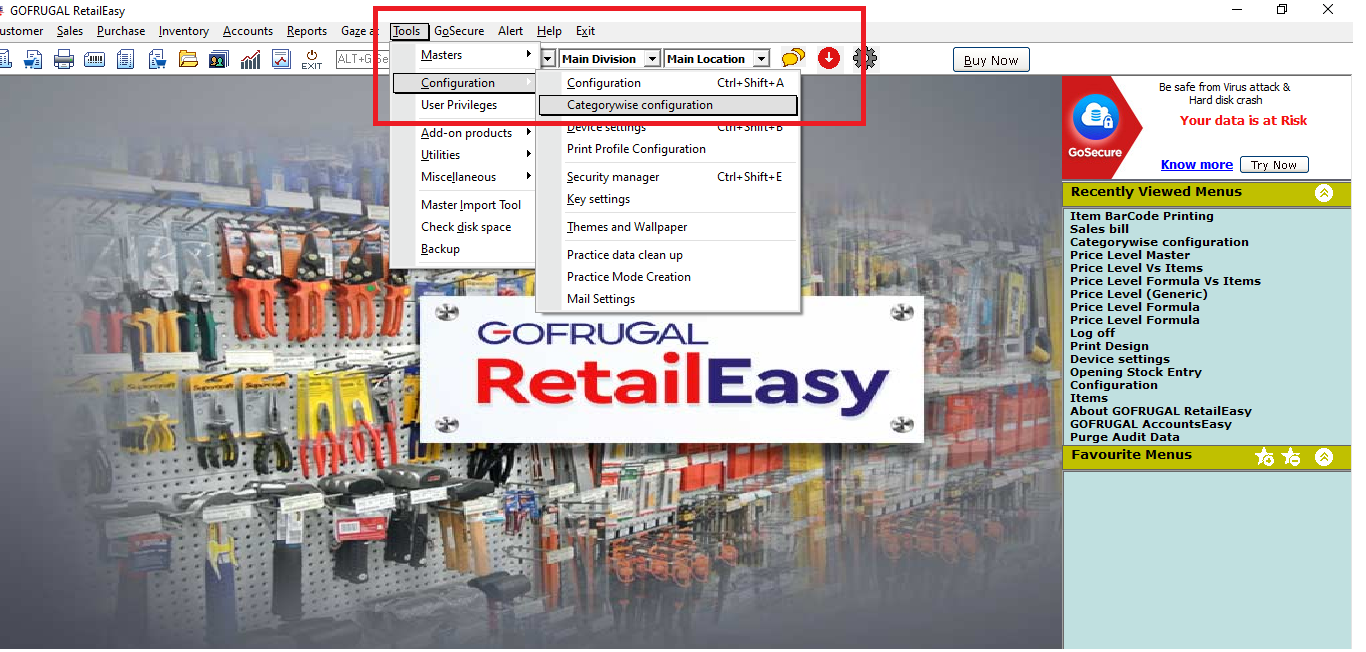

To

enable the one time configuration, navigate to Tools - >

Configuration -> Configuration -> Category wise configuration -

> One Time Configuration - >Enable the configuration : Get TCS

(Tax collected at source) input value in purchase using formula

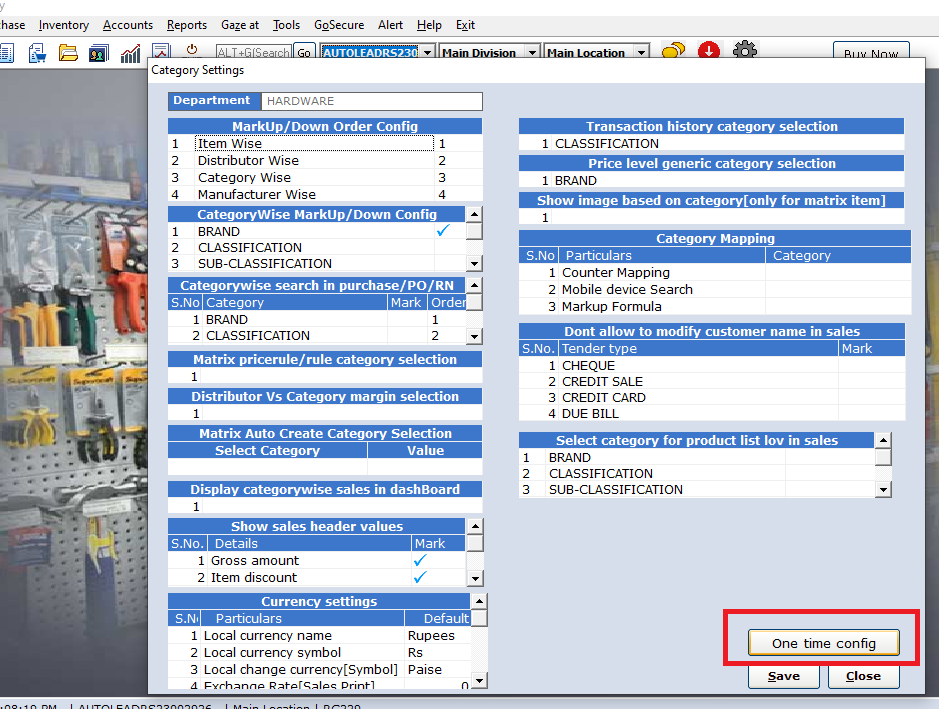

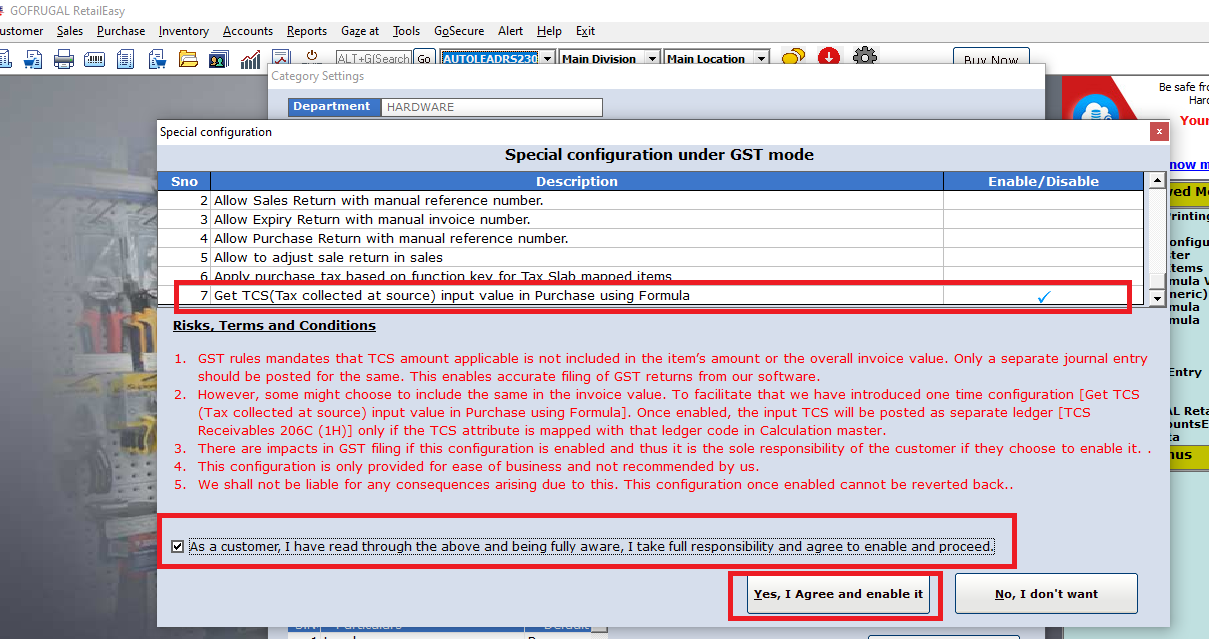

Select

the configuration "Get TCS (Tax collected at source) input value in

purchase using formula " , Go through the risks , terms and

conditions.

Click on Agree to the terms and conditions and select the check box " Yes, I Agree and enable it " to save this configuration.

Once you enable this configuration , it cannot be reverted back.

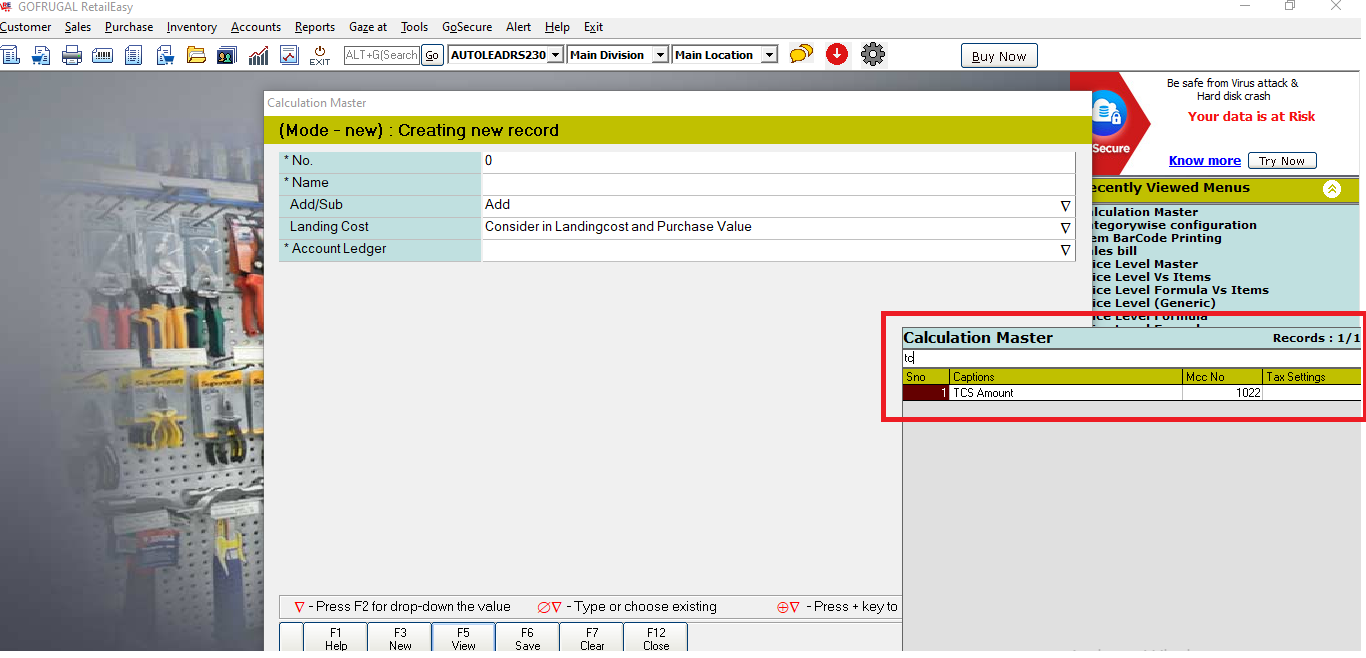

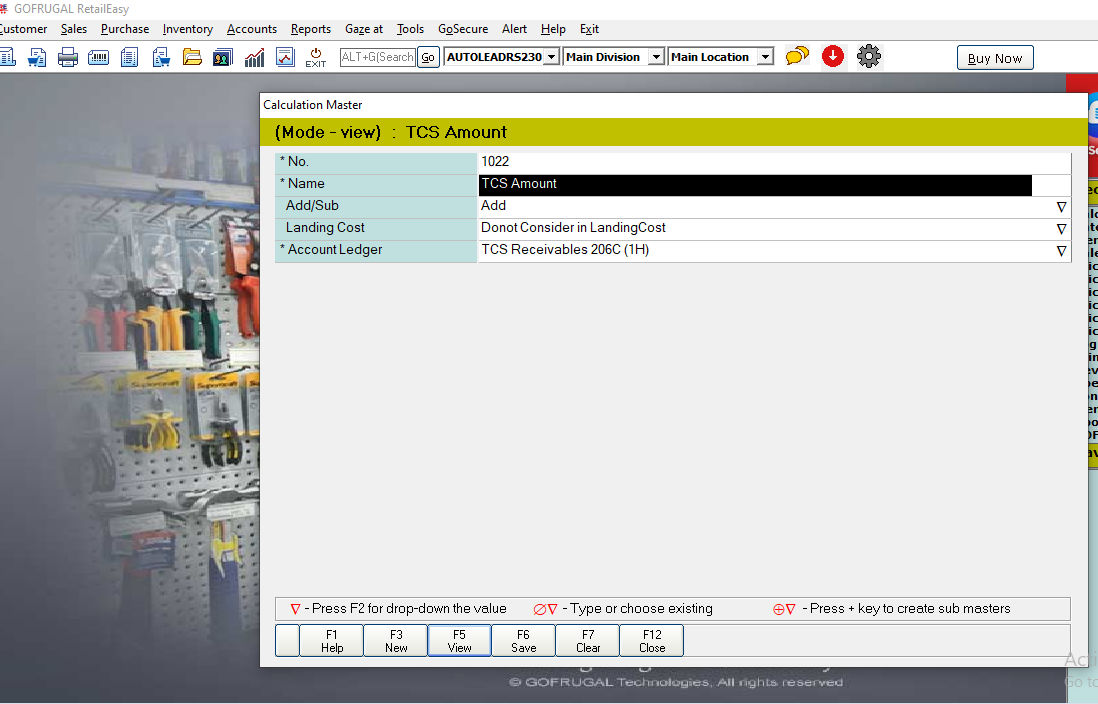

On

Enabling this configuration , TCS Amount master will be created under

calculation master and a new purchase formula ( " GST TCS Formula ") for

TCS calculation will be created automatically.

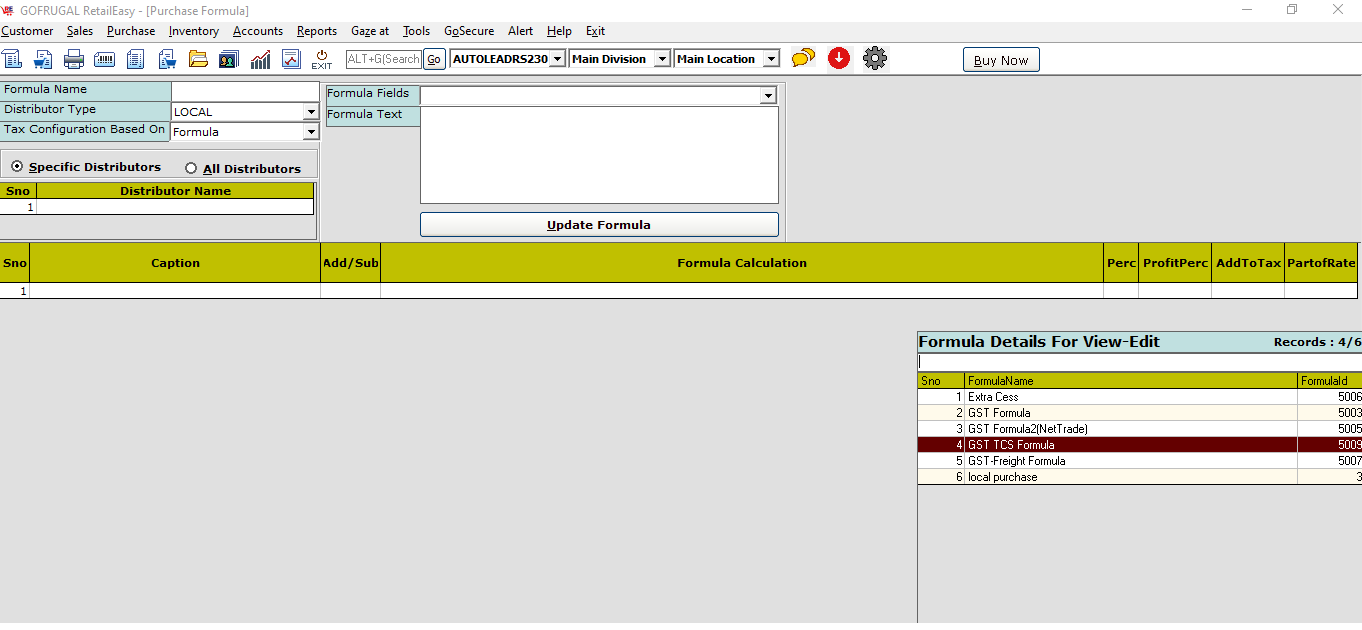

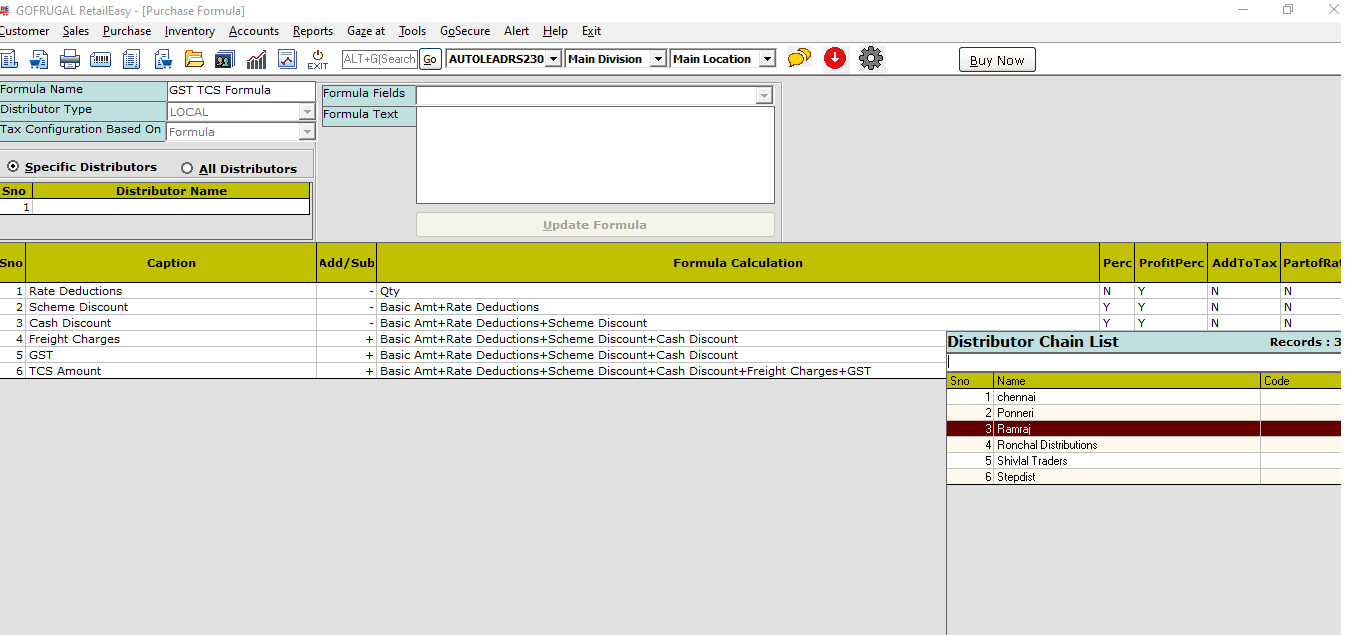

Now, we need to map this purchase formula to the required suppliers.

In order to do so, Navigate to Purchase - > Purchase formula. Click on Change and load the purchase formula " GST TCS Formula " in edit mode.

Select the Distributor under the Distributor name column and click on save

If you want to enable it to all of your suppliers, enable the option All Distributors on the top left radio button.

Note: If this is not required, still you can proceed with the existing method. If this configuration is enabled, we will not be able to input the TCS details under the TCS attribute on more options window.

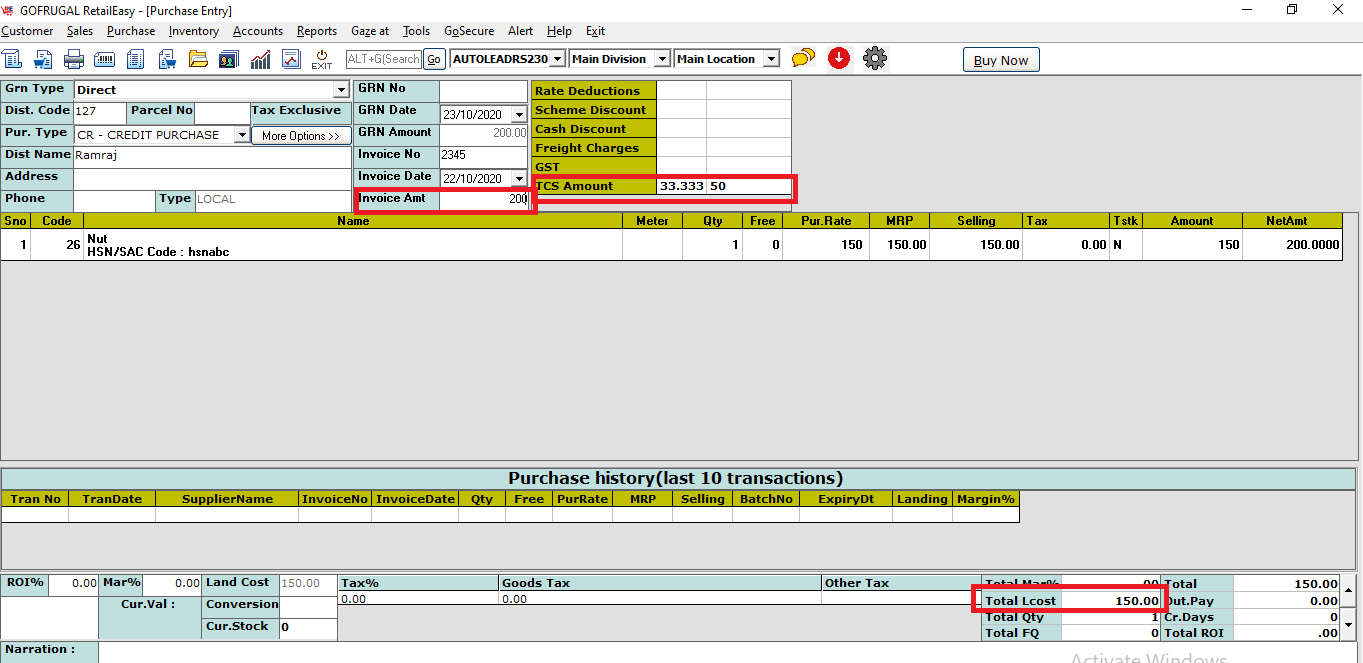

Now

while saving the purchase invoice, input the TCS amount in the TCS

amount column, the tax and TCS calculation will work as per the newly

created formula. (" GST TCS Formula ")

As visible, The TCS Amount is added to the invoice amount and it did not create any impact in the Landing cost.

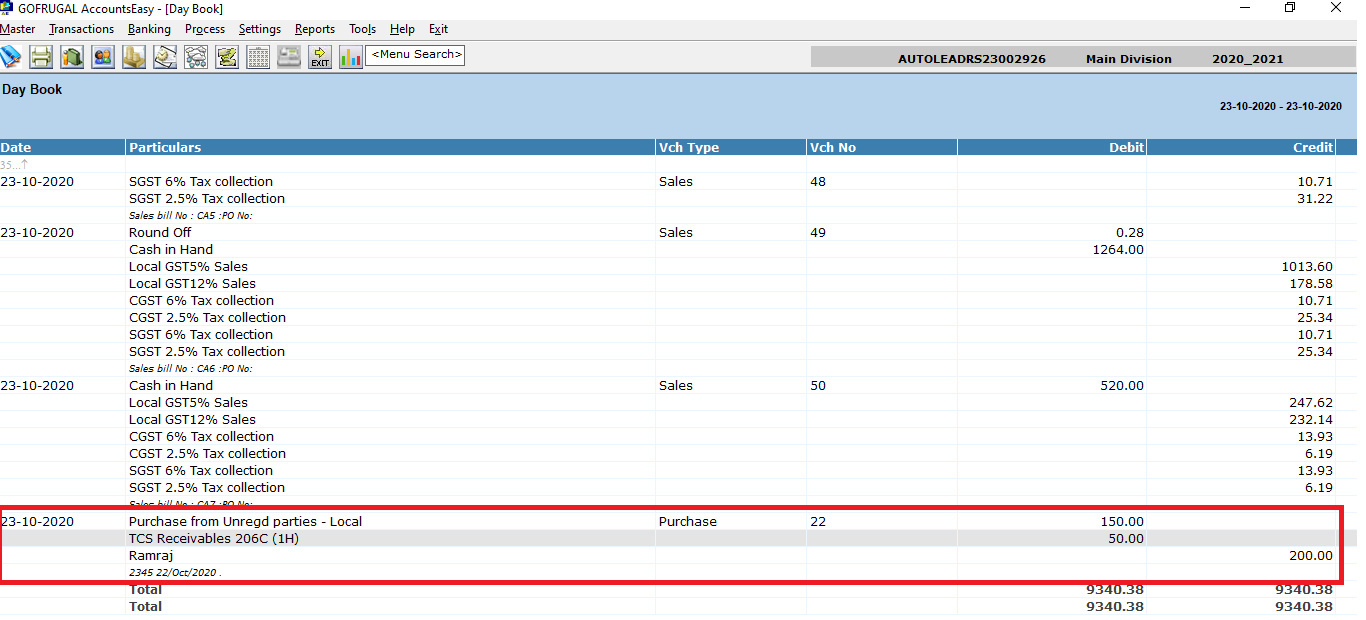

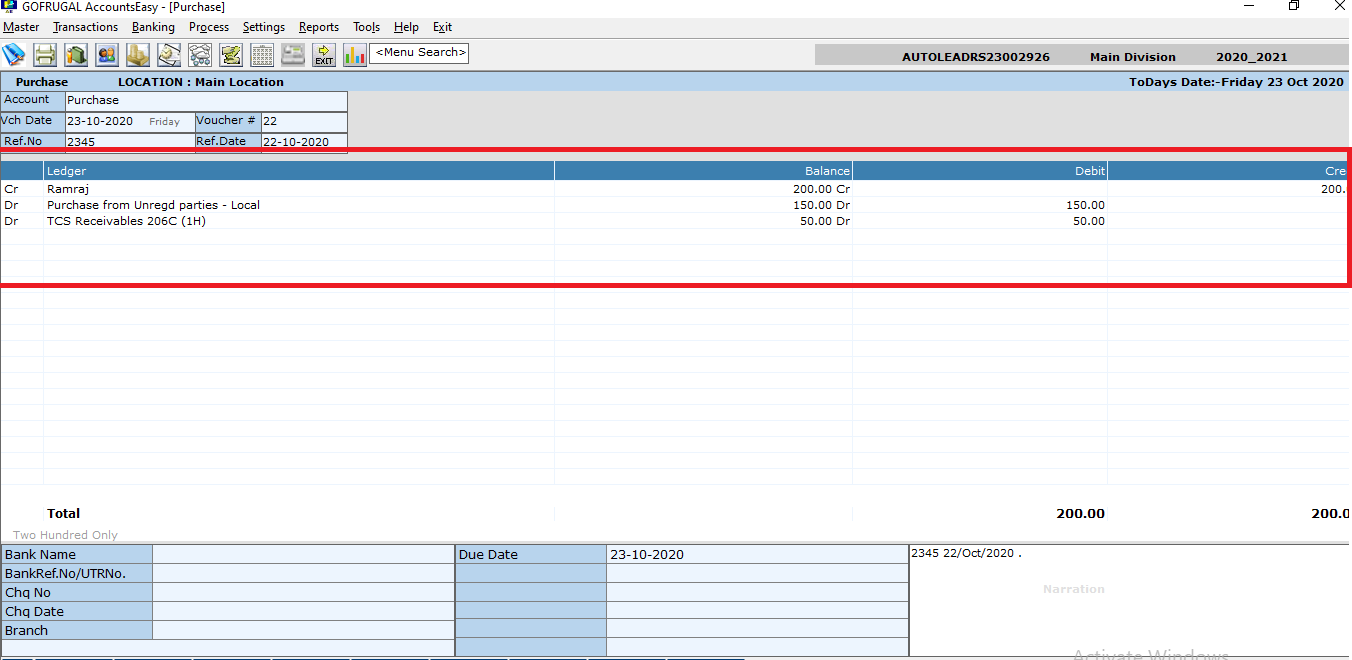

Also, the accounts posting details can be viewed in the Day book report on AccountsEasy

On double clicking the voucher number, it will open the purchase posting details in the drill down.

Related Articles

TCS in Purchase Invoice

What is TCS? 'Tax collected at Source' is abbreviated as TCS. It was applicable for Sale of Goods for items like Tendu leaf, motor Vehicles, Scrap..etc. From 1st October 2020, TCS will be applicable on 'Sale of Goods' for all items. Both TDS & TCS ...How to use RetailEasy [RPOS7] Purchase Formula?

In Gofrugal RetailEasy (RPOS7), the Purchase Formula is one of the most important configurations, as it controls how your item’s purchase rate is calculated inside the software. This directly affects: Stock Value Profit Margin Selling Price decisions ...Landing Cost Without Tax Calculation in RPOS7

Landing Cost Without Tax: Formula and Explanation To explain the complete process, I have prepared the MIT sheet as shown in the screenshot below, which includes four line items. For the first two line items, I have left the Landing Cost field as ...What is Purchase Formula?

Introduction Purchase formula is a formula used to calculate the invoice amount including the discounts and taxes of the purchase. The default Purchase formula is not always helpful to the users as the invoice amount calculation varies for different ...How to Block the Editing of 'Invoice Date' in Purchase & Receipt Note

How to Block the Editing of 'Invoice Date' in Purchase & Receipt Note Purpose: The purpose of block editing the "Invoice Date" is to streamline the invoicing process and make it easier to manage multiple items and invoices. And also helps in using ...