How to configure the tax based on Item Master?

Tax based on Item Master

In certain businesses like Pharmacy, the tax calculation for all the items in an invoice may not be the same. For example, a single invoice may contain many different items. The tax calculation for each item may be based on MRP (inclusive and exclusive) or based on the Purchase price (inclusive and exclusive).

Use the configuration provided below to calculate the purchase tax based on Item Master.

Configuration: Tools >> Configuration >> Purchase >> Common settings (Purchase/Receipt Note) >> Purchase tax calculation based on (Tax on purchase price or Tax on MRP or Tax part of MRP >> Item Master.

Item Master Configuration

1. Click Inventory >> Masters >> Items [CTRL + I]. The Item Master screen is displayed.

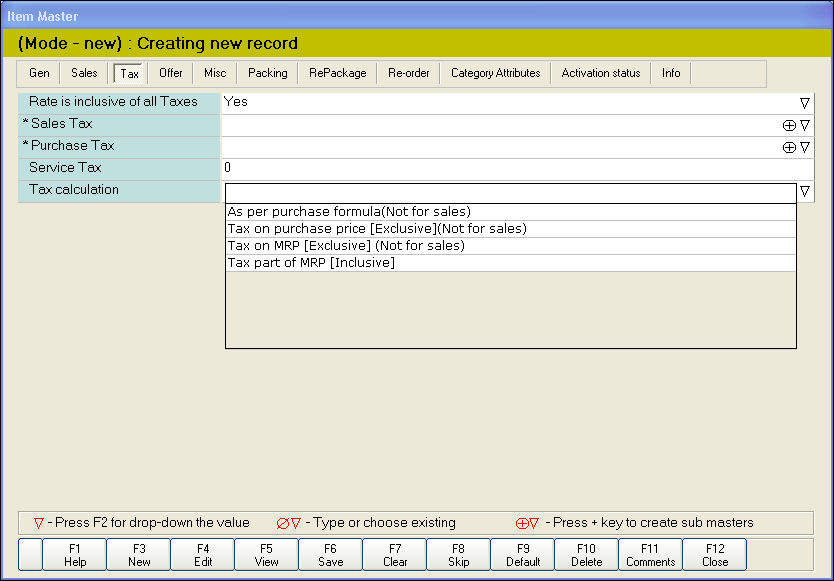

2. Click Tax tab.

3. In the Tax calculation field, press F2 key. The tax calculation drop-down list is displayed. Select from the following options-

In certain businesses like Pharmacy, the tax calculation for all the items in an invoice may not be the same. For example, a single invoice may contain many different items. The tax calculation for each item may be based on MRP (inclusive and exclusive) or based on the Purchase price (inclusive and exclusive).

Use the configuration provided below to calculate the purchase tax based on Item Master.

Configuration: Tools >> Configuration >> Purchase >> Common settings (Purchase/Receipt Note) >> Purchase tax calculation based on (Tax on purchase price or Tax on MRP or Tax part of MRP >> Item Master.

Item Master Configuration

1. Click Inventory >> Masters >> Items [CTRL + I]. The Item Master screen is displayed.

2. Click Tax tab.

3. In the Tax calculation field, press F2 key. The tax calculation drop-down list is displayed. Select from the following options-

- As per Purchase formula (Not for sales)- To calculate tax based on purchase formula

- Tax on Purchase price [Exclusive] (Not for sales) - To calculate tax based on purchase price

- Tax on MRP [Exclusive] (Not for sales)- To calculate tax based on MRP

- Tax part of MRP [Inclusive]- To calculate tax based on MRP tax inclusive

Note: By default, the option As per Purchase formula (Not for sales) is enabled.

Related Articles

Tax Slab & it's mapping

Tax Slab & it's mapping Purpose: The GST council of India has broadly categorized all goods & services into five tax slabs, namely 3%, 5%,12%,18% and 28%. In addition, there is a 0% rate (Nil-rated supplies) for essential goods like salt, jaggery, ...Audit changes on Tax calculation based on Inclusive / Exclusive at the time of Purchase

Audit changes on Tax calculation based on Inclusive / Exclusive at the time of Purchase Purpose: The purpose of auditing changes on tax calculation based on inclusive/exclusive at the time of purchase in POS is to ensure accurate and compliant tax ...Tax Based on Tax Slab Rate in Stock Transfer out Transaction

Tax % Based on Tax Slab Rate in Stock Transfer out Transaction Purpose: The purpose of Tax % based on tax slab rate in stock transfer out transaction in RetailEasy Apparel POS is to calculate and apply the appropriate tax rate on the value of the ...Item Master - Out Attribute

Item Master - Out Attribute Purpose: To collect more details in terms of optical like Spectacles - 1 (Left & Right for cylindrical, Sphere, AS, PD), Spectacles - 2 (RE, Distant Vision, for cylindrical, axis or Sphere either for right eye or left) ...Overwrite tax-slab in Purchase/Receipt Note

Overwrite tax-slab in Purchase/Receipt Note Purpose: The purpose of the "overwrite tax-slab" option in a purchase/receipt note in a POS system is to allow the user to manually adjust the tax rate applied to a particular item or group of items. ...