TCS in Purchase Invoice

What is TCS?

'Tax collected at Source' is abbreviated as TCS. It was applicable for Sale of Goods for items like Tendu leaf, motor Vehicles, Scrap..etc. From 1st October 2020,

TCS will be applicable on 'Sale of Goods' for all items.

Both TDS & TCS are Part of Income Tax (not related to GST). TDS (Tax Deducted at Source), was implemented long back and it is applicable for Salary, Winning from Prize money and all kinds of service incomes.

The TDS will be deducted & paid by the payer. TDS deducted from the payer's invoice by the business who receives the service will be filed to the government.

But TCS will be collected & paid by the PAYEE. (Payer - Person who is receiving the goods/service, Payee - Person who is providing the goods/service and is Income to the person)

Below are the steps to easily make a TCS entry for a purchase

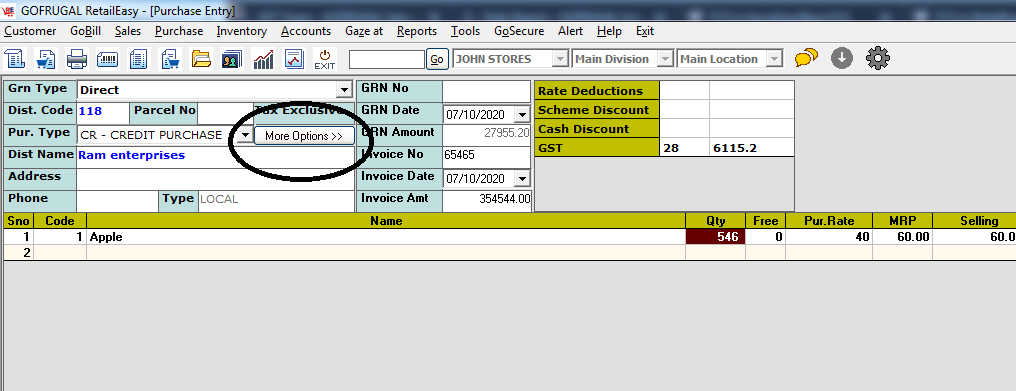

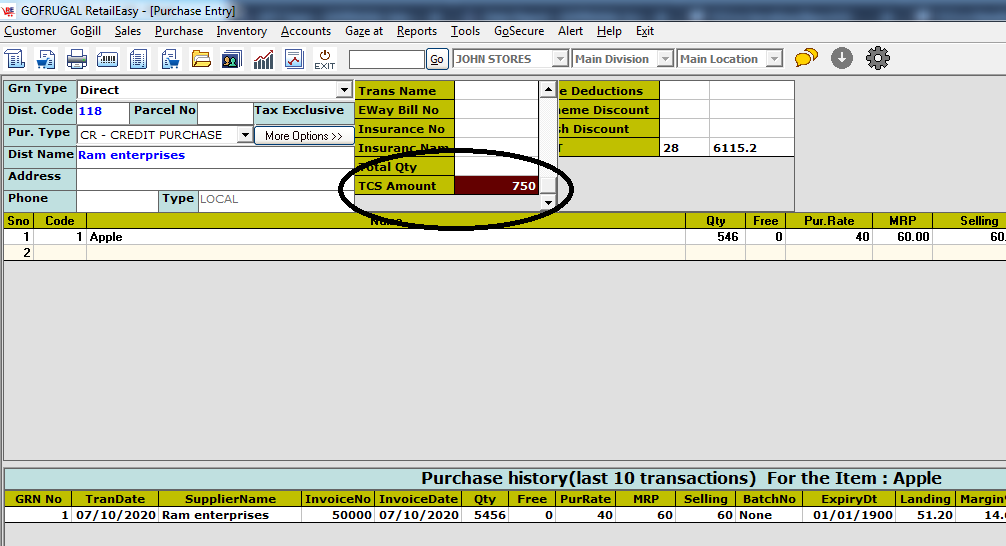

#TCS for a purchase entry

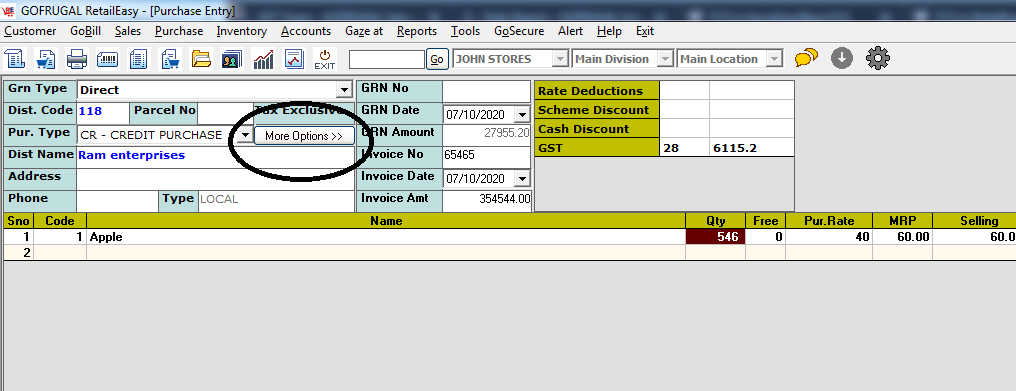

Step 1 : In the left of the purchase entry screen, click "more options"

Step 3: Choose the supplier/ party from the ledger list

TCS will be applicable on 'Sale of Goods' for all items.

Both TDS & TCS are Part of Income Tax (not related to GST). TDS (Tax Deducted at Source), was implemented long back and it is applicable for Salary, Winning from Prize money and all kinds of service incomes.

The TDS will be deducted & paid by the payer. TDS deducted from the payer's invoice by the business who receives the service will be filed to the government.

Below are the steps to easily make a TCS entry for a purchase

#TCS for a purchase entry

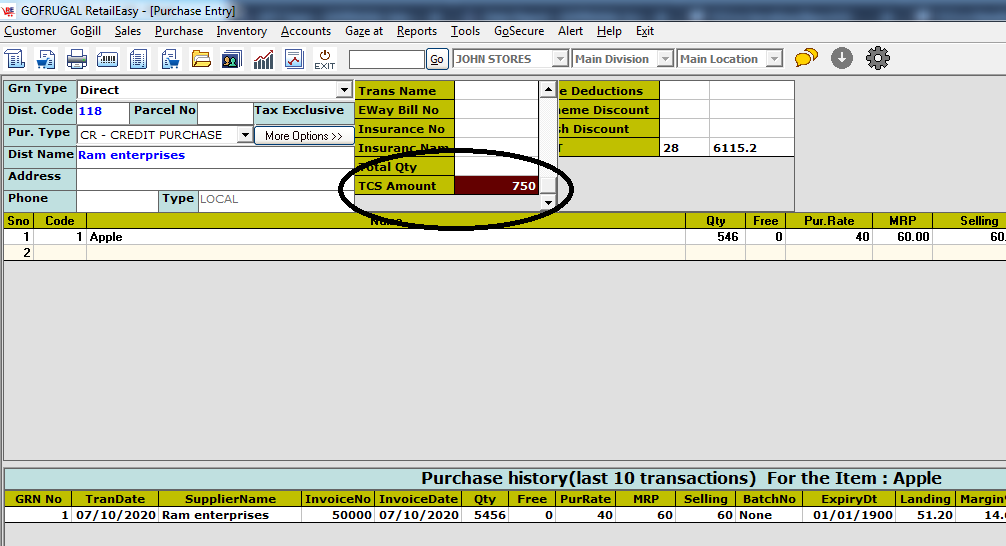

Step 2 : Scroll down to find the "TCS amount" row. Enter

the TCS amount in the column and continue to put the purchase entry.

Once saved, a journal entry will be automatically passed for the TCS

value. (TCS is exclusive of the invoice amount)

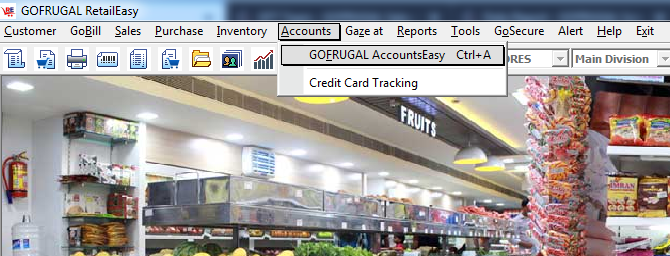

#Verification in reports

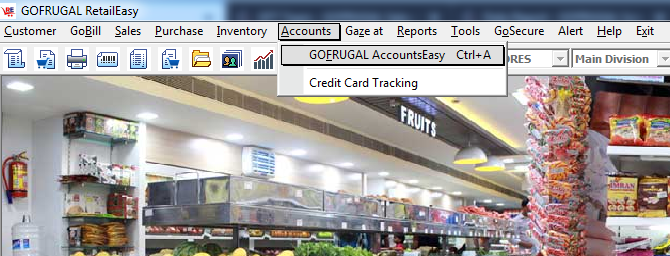

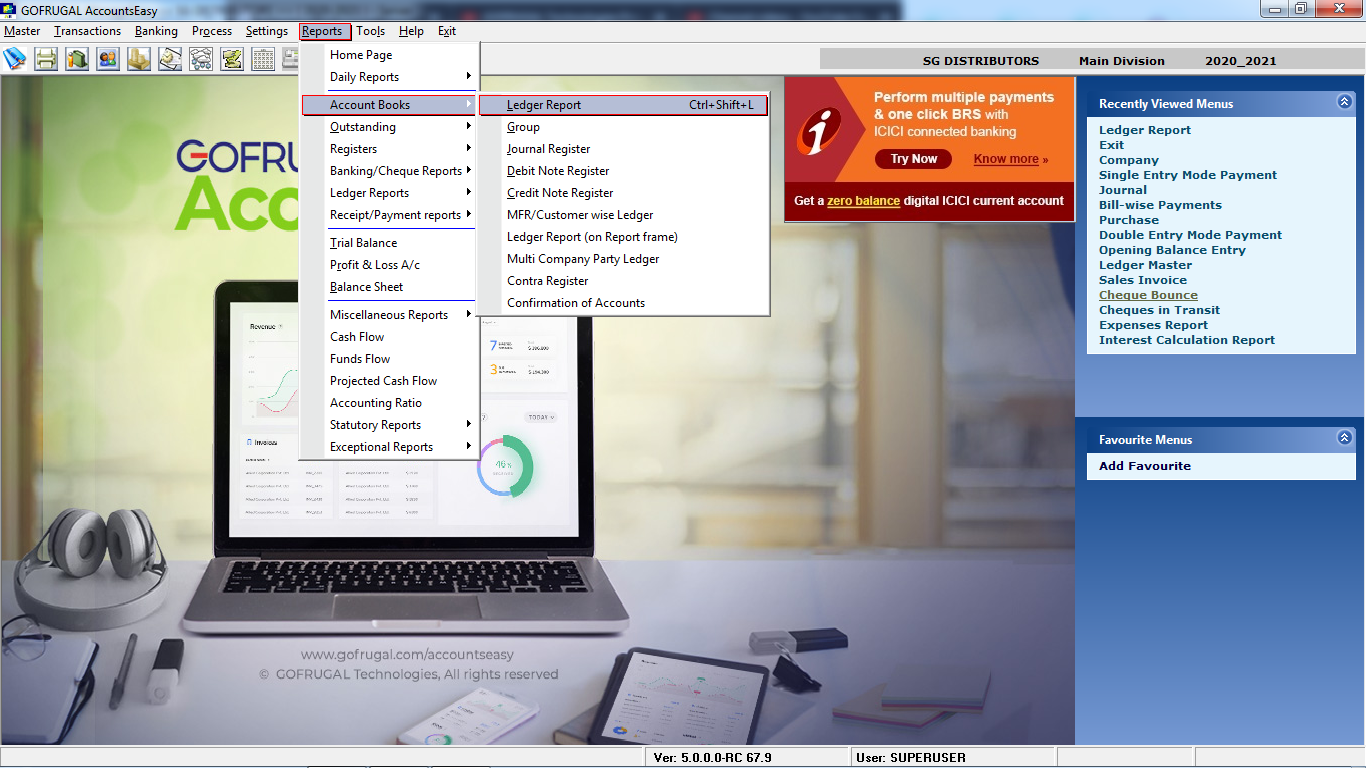

Step 1 : Navigate to GOFRUGAL AccountsEasy module under Accounts

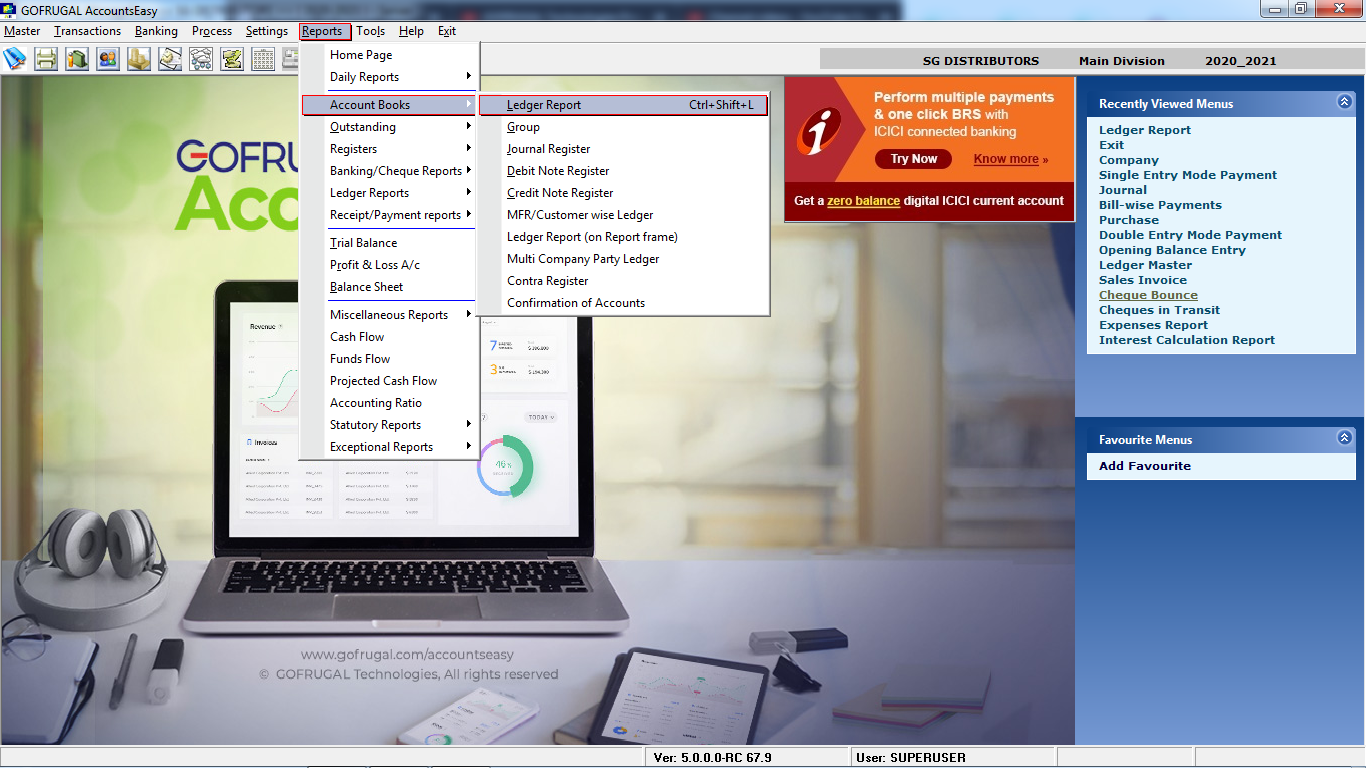

Step 2 : In

the AccountsEasy screen, navigate to Ledger report. (Can also be

viewed in other reports like day book, journal register etc...)

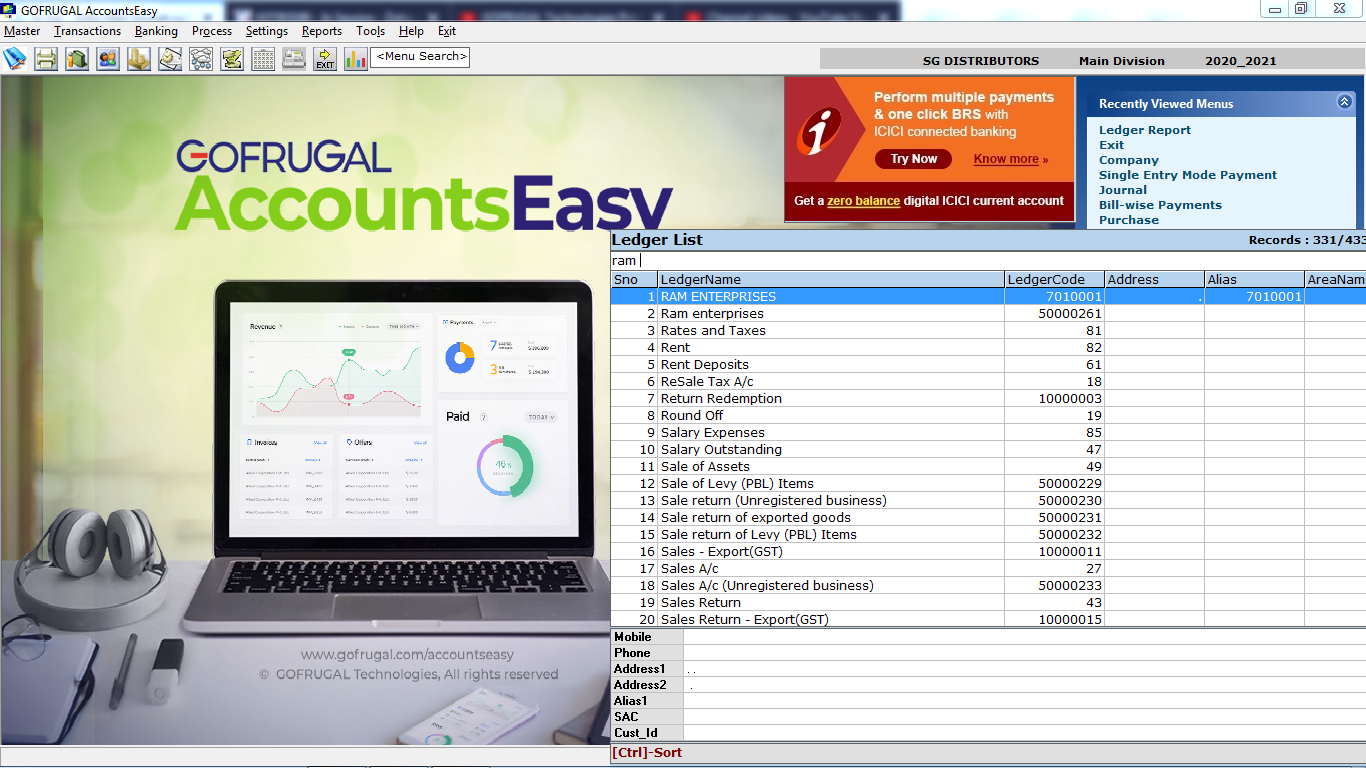

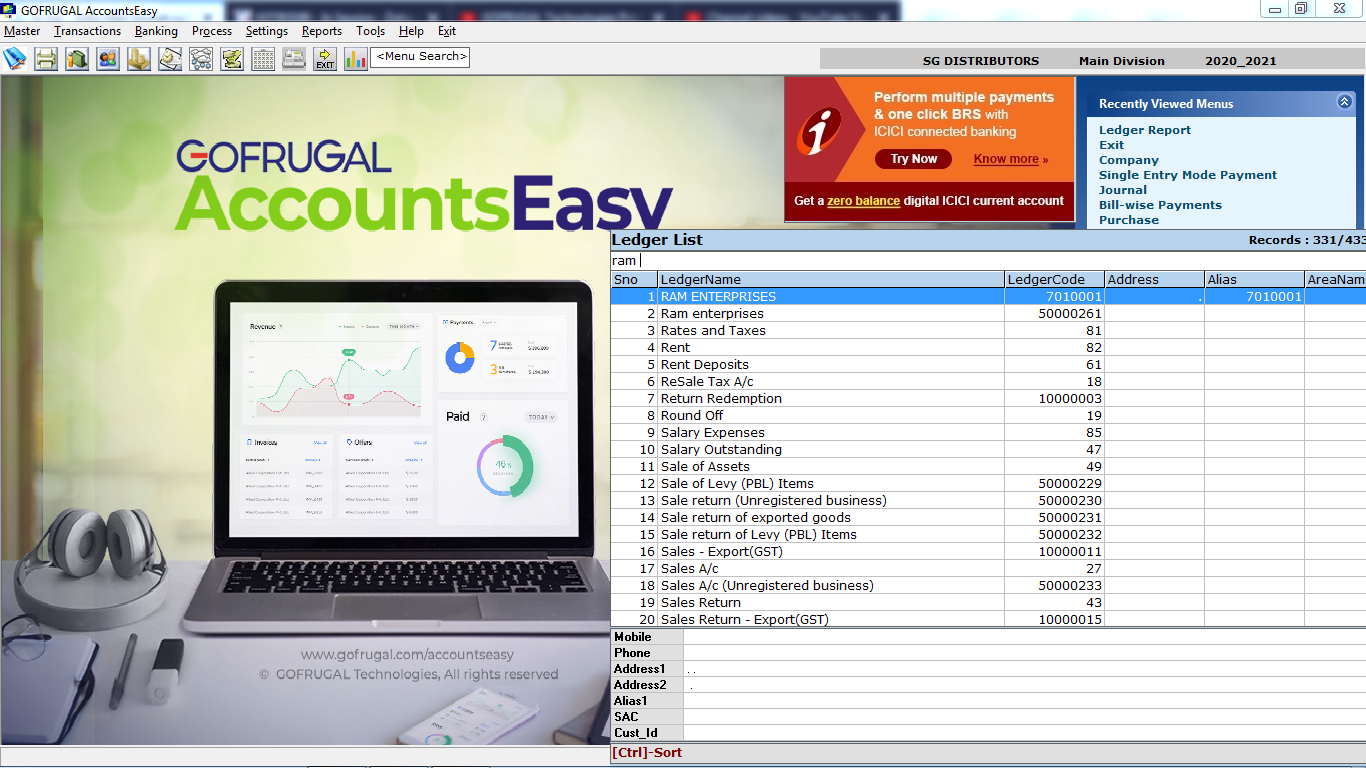

Step 3: Choose the supplier/ party from the ledger list

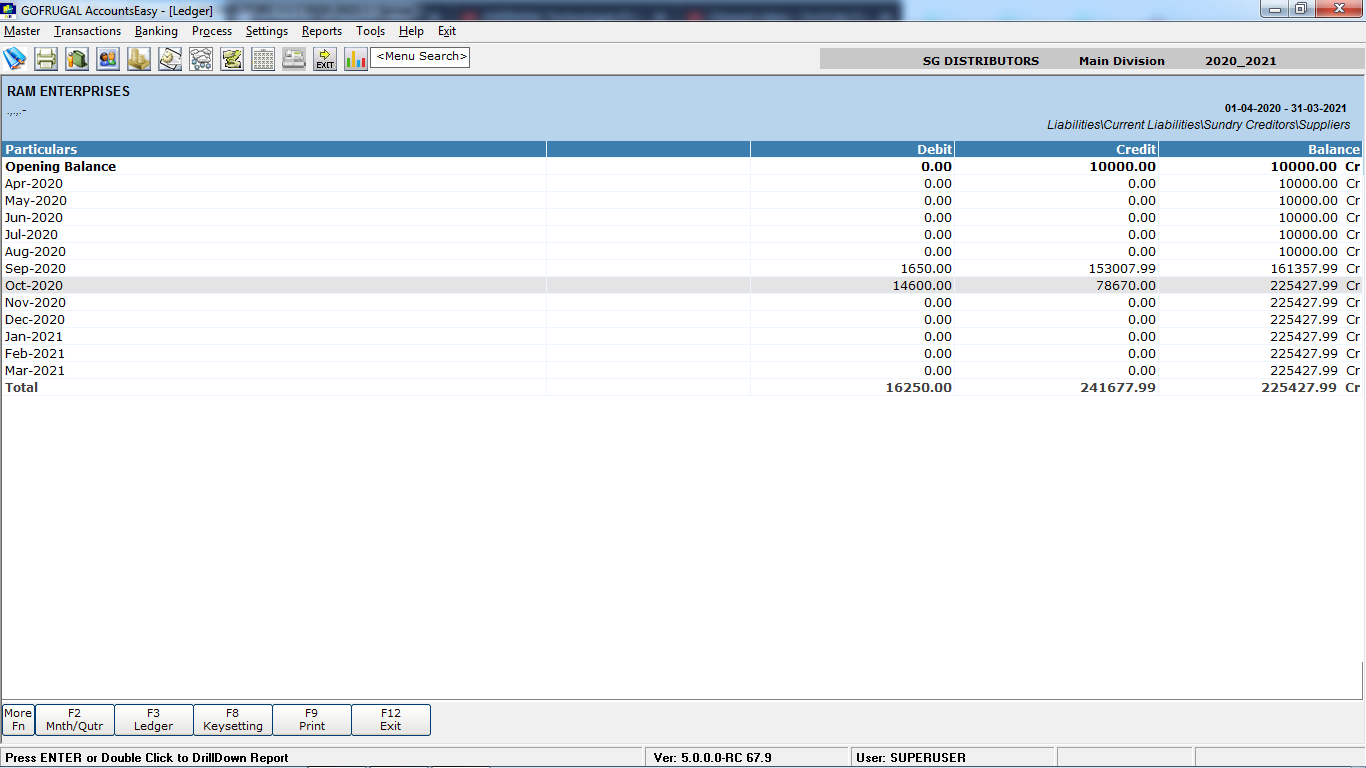

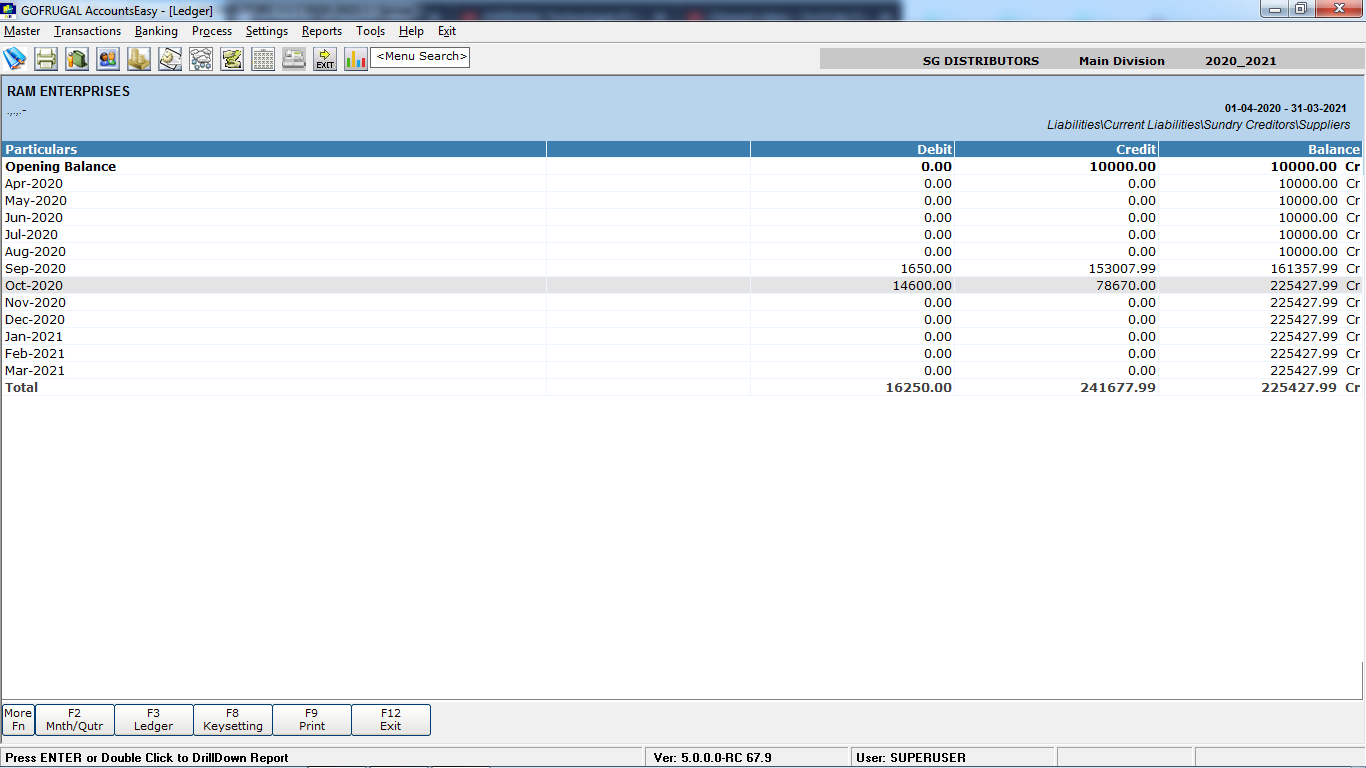

Step 4 : Drill down for the required period by clicking enter

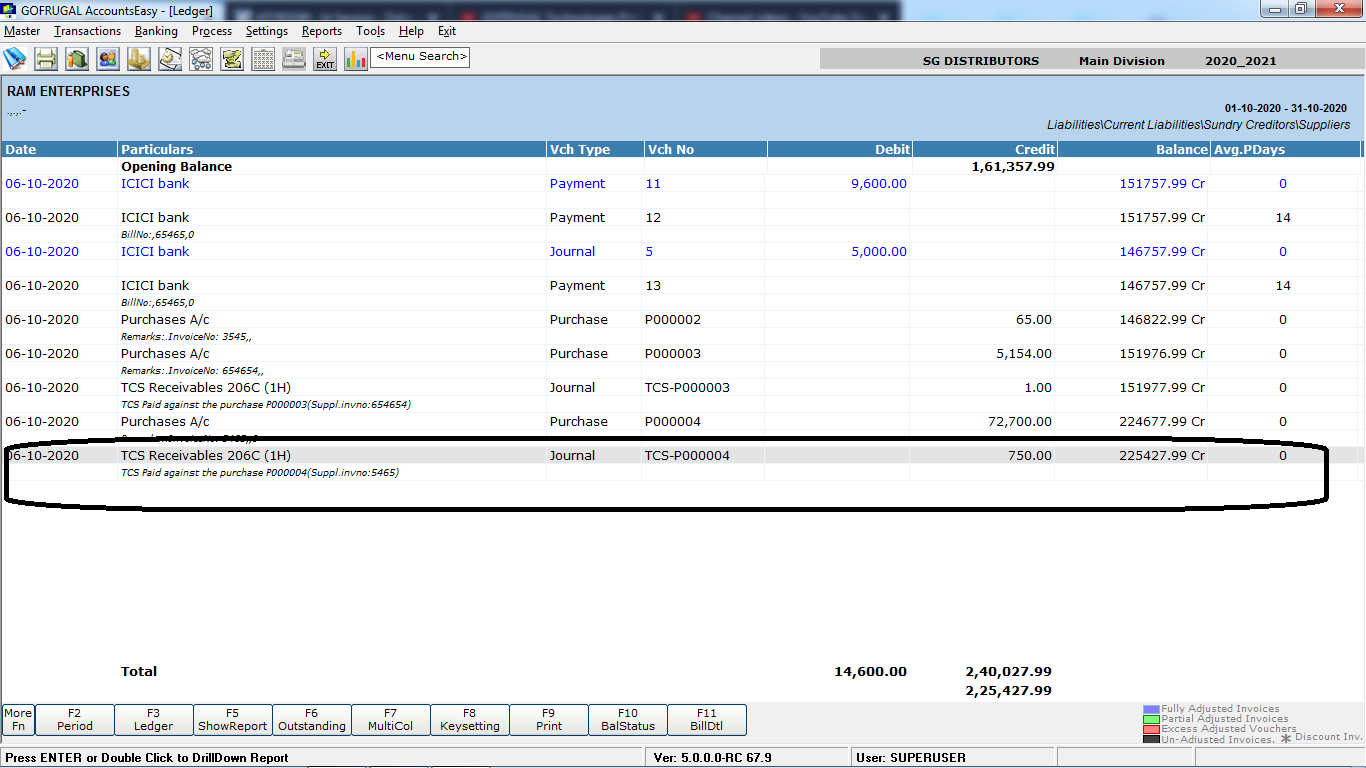

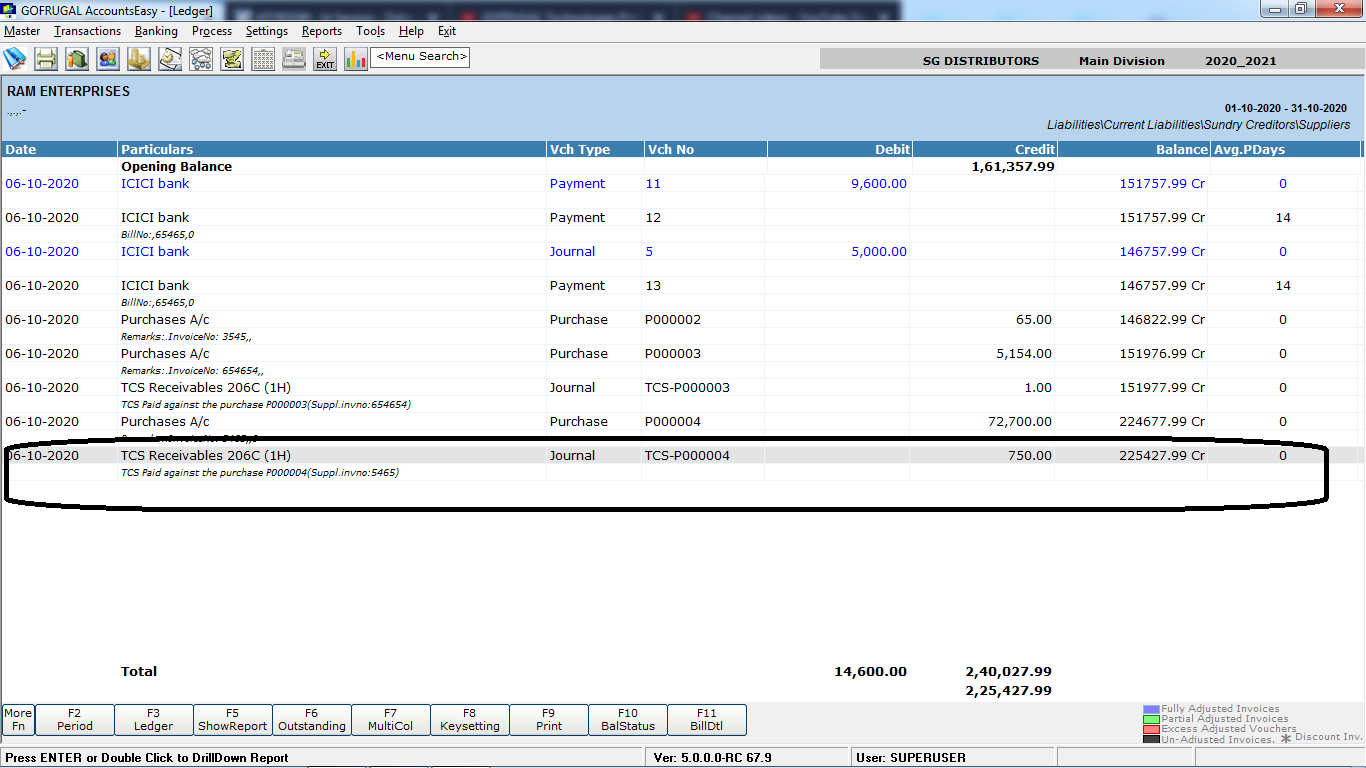

Step 5: In the below screen we can view the automatic TCS journal entry posted under the supplier ledger

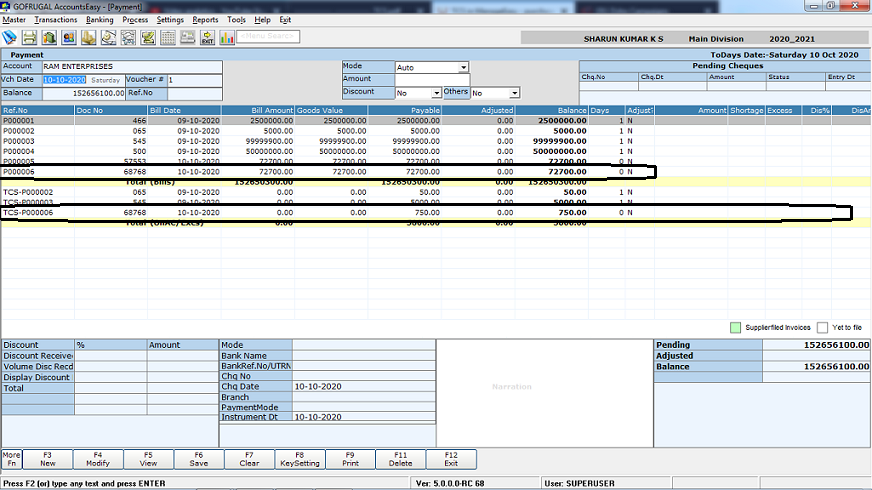

#TCS Outstanding report and clearance in AccountsEasy

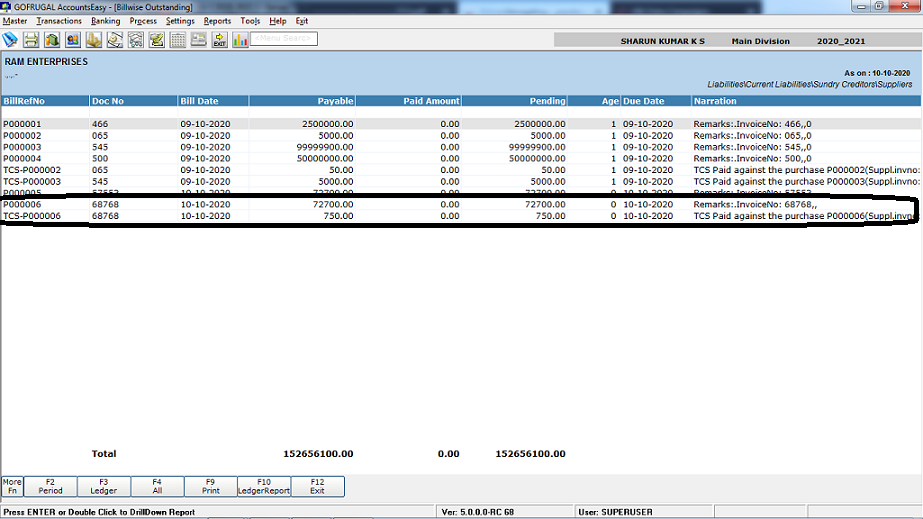

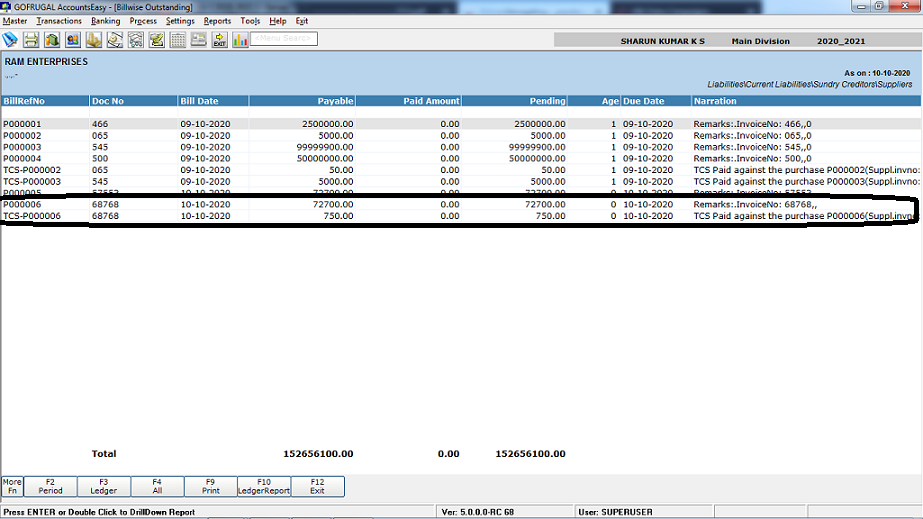

To view the outstanding report : Go to Reports -> outstanding -> supplier outstanding report

-> choose the customer ledger -> Drill down the respective

month

In the below image, you can view the sales bill of Rs 71,250 and it's TDS journal entry

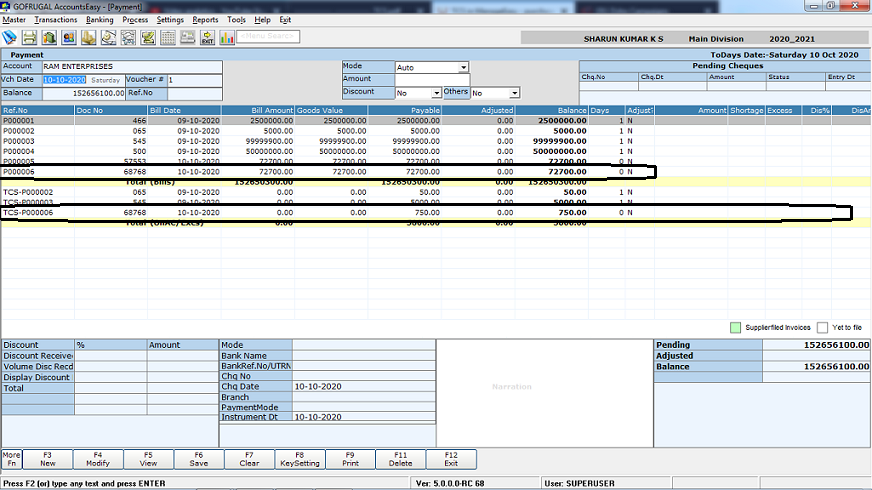

To clear the outstanding : Go to Transactions -> bill wise receipts ( Can also be adjusted in single entry mode receipt screen)

In

the below image you can notice the sales bill of Rs 71,250 and its

TDS journal entry of Rs 53.44. In this screen we can adjust the

bills

https://www.youtube.com/watch?v=n7OISqS8buE - view this youtube to use bill wise receipt entry screen

https://www.youtube.com/watch?v=Pu8CkKFYk5o - view this youtube to use single entry mode receipt screen

Related Articles

Purchase Formula with TCS

Purpose: Generally, The TCS amount would not be added in the invoice amount and the landing cost. But, If the TCS amount needs to be included in the invoice amount, it can be done with this feature " Purchase Formula with TCS" This feature is ...How to use RetailEasy [RPOS7] Purchase Formula?

In Gofrugal RetailEasy (RPOS7), the Purchase Formula is one of the most important configurations, as it controls how your item’s purchase rate is calculated inside the software. This directly affects: Stock Value Profit Margin Selling Price decisions ...Landing Cost Without Tax Calculation in RPOS7

Landing Cost Without Tax: Formula and Explanation To explain the complete process, I have prepared the MIT sheet as shown in the screenshot below, which includes four line items. For the first two line items, I have left the Landing Cost field as ...What is Purchase Formula?

Introduction Purchase formula is a formula used to calculate the invoice amount including the discounts and taxes of the purchase. The default Purchase formula is not always helpful to the users as the invoice amount calculation varies for different ...How to Block the Editing of 'Invoice Date' in Purchase & Receipt Note

How to Block the Editing of 'Invoice Date' in Purchase & Receipt Note Purpose: The purpose of block editing the "Invoice Date" is to streamline the invoicing process and make it easier to manage multiple items and invoices. And also helps in using ...