How to map the purchase invoice fields?

Mapping the Purchase Invoice fields

After adding the distributor name in the Import list, you are required to do the manual mapping of the fields. This is essential because the field name in the purchase invoice and in our template may not be exactly the same.

Follow the steps below for mapping the fields.

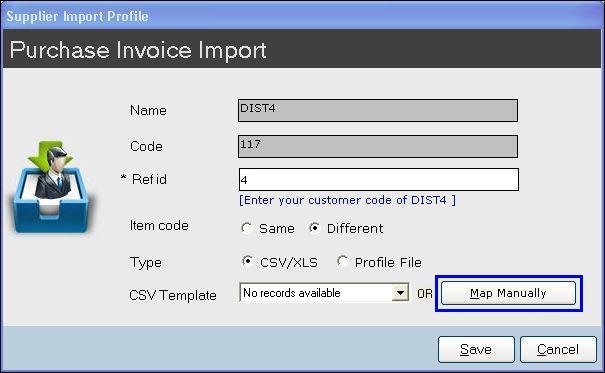

The added distributor name is displayed in the Purchase Invoice Import screen.

1. Enter the Ref id in the Ref id field.

2. Select the option Same if the item code in the Item Master and the invoice are one and the same (or) select the option Different if the item codes are different.

3. Click Map Manually. The field mapping screen is displayed.

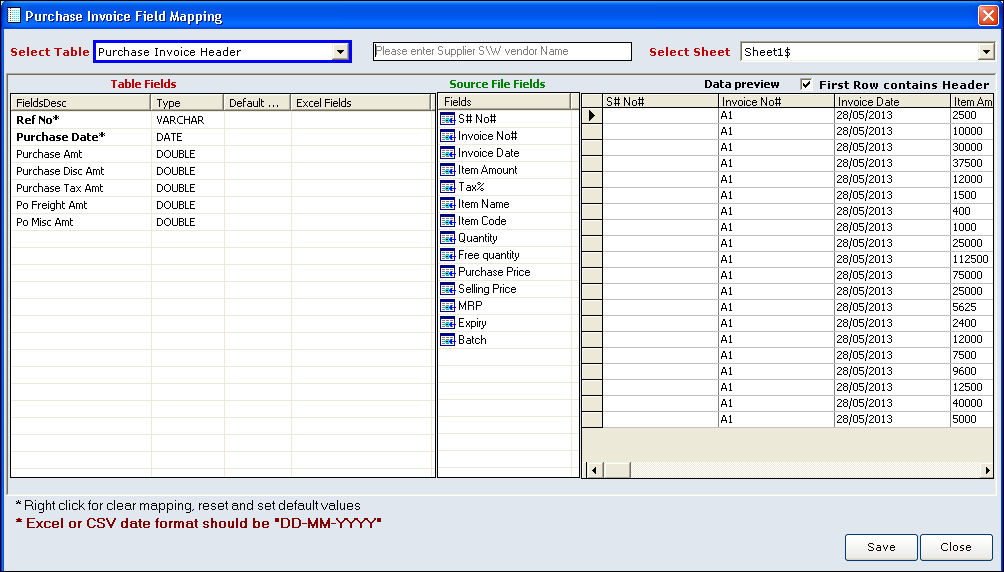

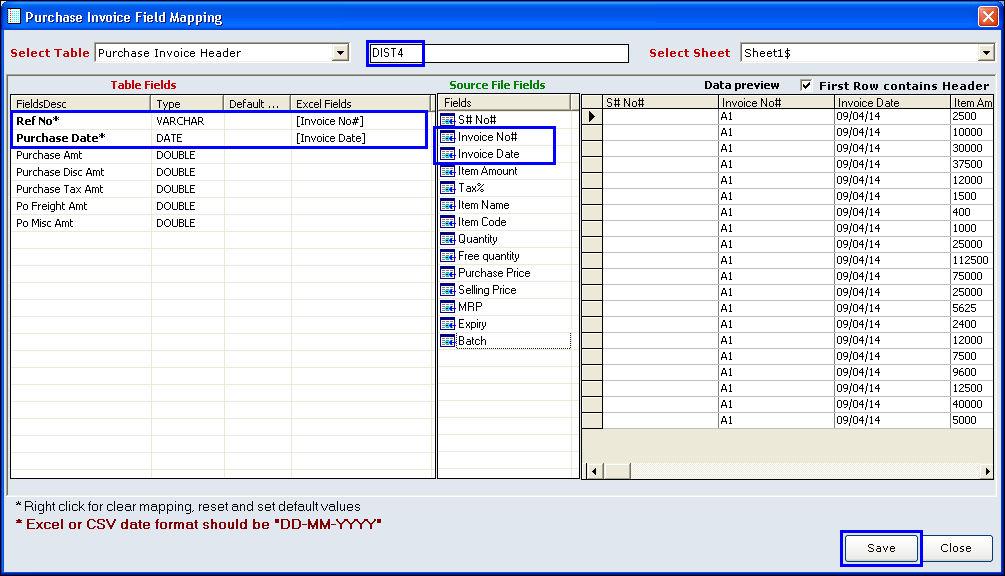

4. By default, the Purchase Invoice Header is selected. The header includes information like Invoice Number, Invoice date, Purchase discount etc.

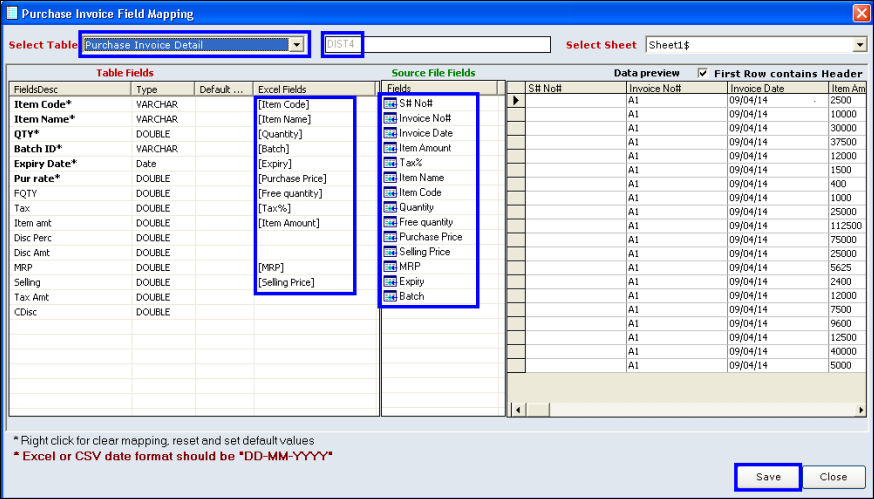

5. Enter the Distributor name.

6. Map the fields from the source file (of the distributor) with the ones in the product template. This is done by dragging the source file fields and dropping in the Excel fields.

7. Click Save.

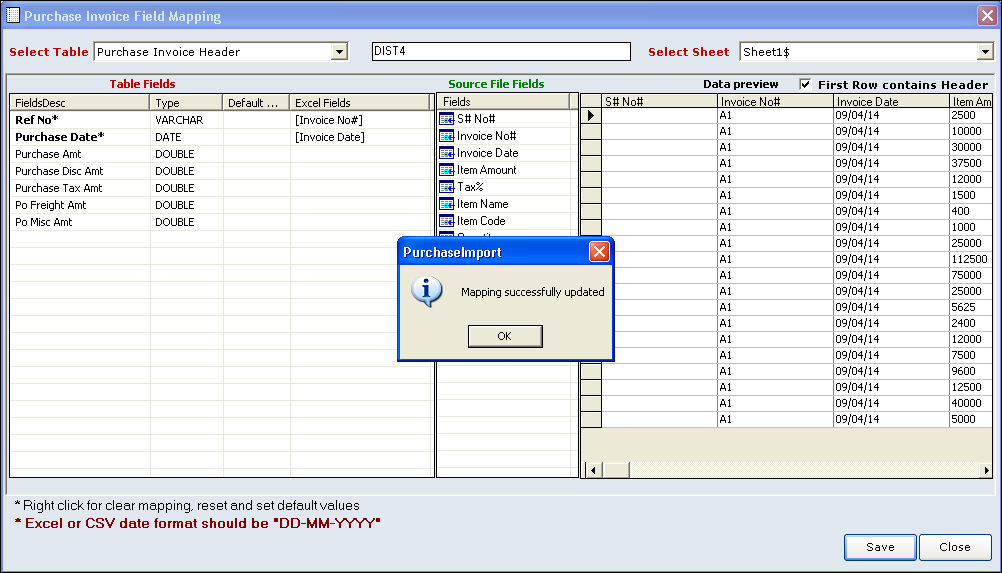

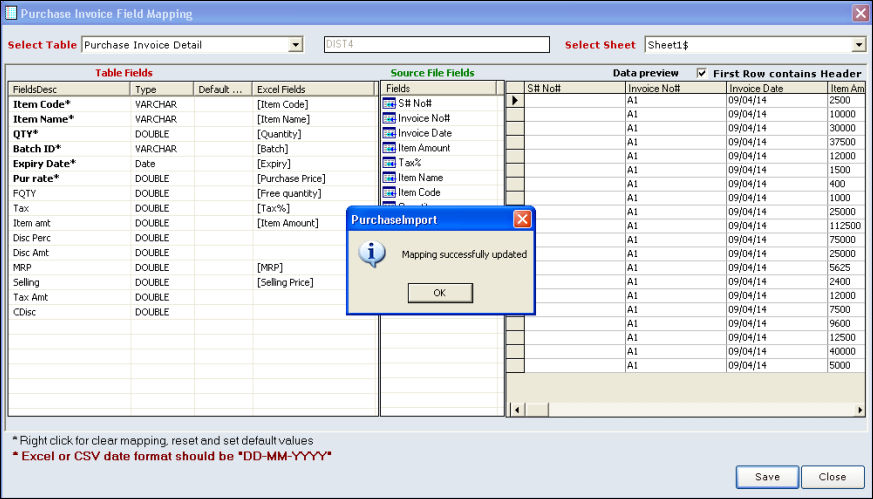

8. A confirmation message 'Mapping successfully updated' is displayed. Click OK.

9. Select the field Purchase invoice details for the selected distributor. The details includes Item name, item code, quantity, selling price, MRP, expiry etc.

10. Map the required fields by drag and drop. Click Save.

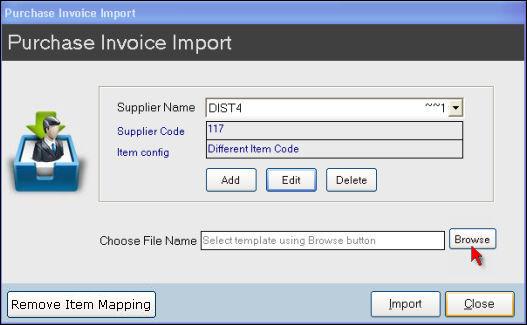

11. The Purchase Invoice Import screen is displayed.

12. Click Browse to select the purchase invoice file. To continue further, click here

After adding the distributor name in the Import list, you are required to do the manual mapping of the fields. This is essential because the field name in the purchase invoice and in our template may not be exactly the same.

Follow the steps below for mapping the fields.

The added distributor name is displayed in the Purchase Invoice Import screen.

1. Enter the Ref id in the Ref id field.

2. Select the option Same if the item code in the Item Master and the invoice are one and the same (or) select the option Different if the item codes are different.

3. Click Map Manually. The field mapping screen is displayed.

4. By default, the Purchase Invoice Header is selected. The header includes information like Invoice Number, Invoice date, Purchase discount etc.

5. Enter the Distributor name.

6. Map the fields from the source file (of the distributor) with the ones in the product template. This is done by dragging the source file fields and dropping in the Excel fields.

7. Click Save.

8. A confirmation message 'Mapping successfully updated' is displayed. Click OK.

9. Select the field Purchase invoice details for the selected distributor. The details includes Item name, item code, quantity, selling price, MRP, expiry etc.

10. Map the required fields by drag and drop. Click Save.

11. The Purchase Invoice Import screen is displayed.

12. Click Browse to select the purchase invoice file. To continue further, click here

Related Articles

How to map the items and import the invoice?

Item Mapping After mapping the fields, you are required to do the mapping of the items. This is essential because the item names in the purchase invoice and in Item Master may not be exactly the same. Follow the steps below for mapping the items. ...FAQs - Purchase Import

Table of Contents [ Hide] 01. What is purchase Import? 02. Where will I get the Purchase invoice from? 03. What if my distributor did not provide me the invoice? 04. Can I import the purchase import in any format? 05. What should I do if I do not ...TCS in Purchase Invoice

What is TCS? 'Tax collected at Source' is abbreviated as TCS. It was applicable for Sale of Goods for items like Tendu leaf, motor Vehicles, Scrap..etc. From 1st October 2020, TCS will be applicable on 'Sale of Goods' for all items. Both TDS & TCS ...Purchase Formula with TCS

Purpose: Generally, The TCS amount would not be added in the invoice amount and the landing cost. But, If the TCS amount needs to be included in the invoice amount, it can be done with this feature " Purchase Formula with TCS" This feature is ...How to Block the Editing of 'Invoice Date' in Purchase & Receipt Note

How to Block the Editing of 'Invoice Date' in Purchase & Receipt Note Purpose: The purpose of block editing the "Invoice Date" is to streamline the invoicing process and make it easier to manage multiple items and invoices. And also helps in using ...